By: Mike Kulej

The Euro stabilized to some degree in days following the agreement to aid Greece for the second time. It seems that fears about possible dissolution of the common currency are gone, at least for now, allowing the EUR to rally against some of its counterparts.

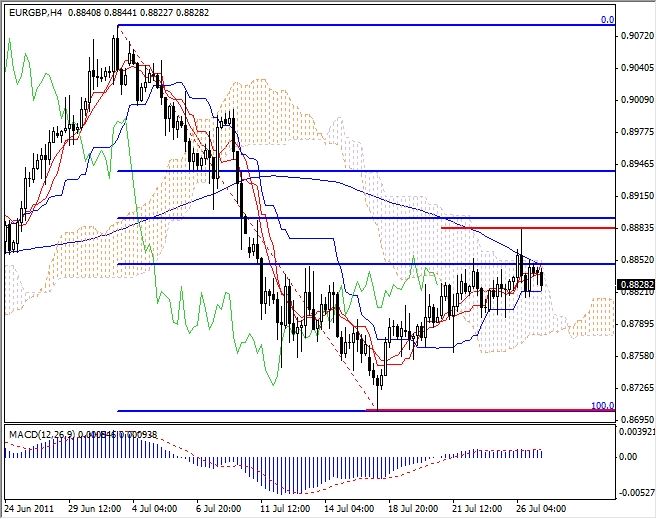

In case of the EUR/GBP pair, this rally has not been very impressive. After a decline from 0.9083 to 0.8704, the price slowly appreciated to 0.8883 a level almost equal to 50% Fibonacci retracement level of the downswing. This creates a strong possibility of reversal and resumption of the downtrend.

On a positive note for the EUR/GBP, this recent run up broke through couple of resistance levels. The price managed to move above the Ichimoku cloud and the 100SMA. However, it failed to stay there, dropping to the current level of 0.8828.

Under these conditions, the EUR/GBP is likely to continue lower, especially if the MACD turns negative, too. The price could possibly test the support of 0.8704 within few days. We must watch the 0.8883 resistance, though – a move above that level might swing momentum into bullish again.