By: FXRenew

Fundamental Case

While in absolute terms there is no question whether the Australian economy remains in much better shape than that of the US. Even in relative terms, the US “recovery” is falling apart faster than Australia is decelerating. However, from a global growth and, more importantly, global risk standpoint, the USD may be poised to gain on AUD further in the short-term. It is our view that AUD/USD will trade below parity again before advancing to new all-time highs; if such a rally is in the offing. Australia is heavily dependent on China, which has been aggressively tightening monetary policy to cool growth and inflation. At present, many economists are noting a Chinese slowdown in progress. Australian data have also been deteriorating in the last month, and RBA rate hikes look unlikely in the near-term. In short, all positives may already be priced in or discounted. Perhaps most worrisome is the fact that AUD has been closely correlated to US equities markets. After a deep rout, stocks have bounced back in the last few days while still looking quite vulnerable. The most recent COT report from the CFTC shows a massive reduction in net longs on AUD held by large speculators, from over 75,000 to just 29,000. This means big players may be looking for deeper pullback before buying back in. Most bets in forex overall appear very short-sighted at this time. This recipe leaves AUD vulnerable at these levels.

Technical Breakdown

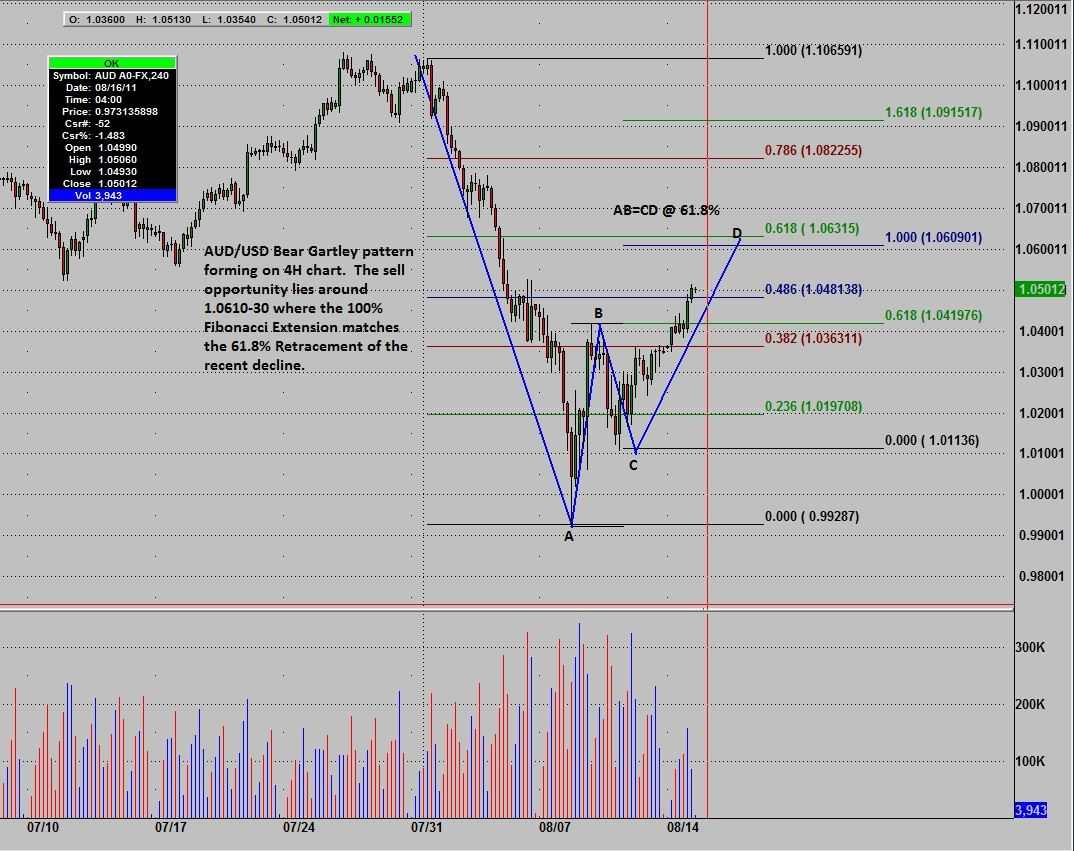

The Bear Gartley pattern shown in the chart below looks like a skewed “W.” Following a sharp decline of more than 1,000 pips, AUD/USD has now recovered above half of those losses. Given the downside conviction and liquidation by large spec accounts, the 48.6% Fibonacci Retracement could be the top. However, looking at the ABCD correction higher, we are targeting a short in the 1.0610-40 area. The 100% Fibonacci Extension marks the point D, where AB=CD. We generally prefer Gartley patterns to complete at the 78.6% Fib Retracement, but given the significance of the decline it seems unlikely that a move to 78.6% would reverse lower again. Such substantial rallies or sell-offs are often followed by more shallow retracements.

Our long-term technical and fundamental bias remains short USD. This trade set-up is intended for an intermediate-term trade, lasting from 1-3 weeks. There are several approaches to setting profit targets, depending on your position size and willingness to allow winners to run. Our first profit target will likely fall in the 1.02-1.03 area, and the stop trailed lower. Additional targets include 0.9950 and 0.9725. Given the distance between 61.8 and 78.6, our stop loss will likely be just above 1.0700. A daily closing price above the 61.8% would void the trade.