By: Colin Jessup

The Euro was confined to narrow ranges ahead of the US open on Monday with resistance close to the 1.43 level as investors remained tentative over conditions, but the currency then advanced strongly in the New York Session.

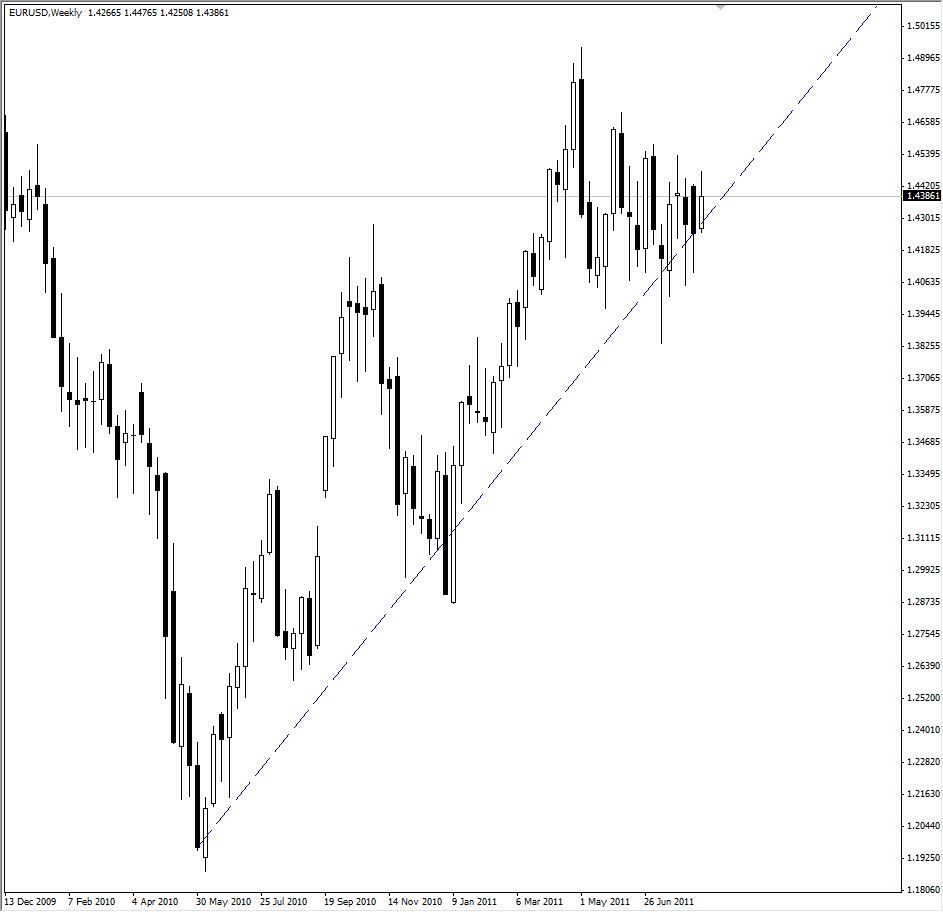

Now the EUR/USD appears to be setting itself up for a nice upward move towards 1.4580 level. Resistance can be seen around 1.4465 with most traders focussed to buy EUR/USD on dips and key retracement level around 1.4320. Both the long term and intra-day traders will be aiming to buy initially around 1.4320 level where we have an ascending trend-line going as far back as May 2010. If the EUR/USD extends it retracement below that level however, then the bears may take over and the next target will be 1.4235, providing good opportunities for averaging out both the entries. Also of interest is that the weekly candle chart has formed something of a flag, also known as an axe or a hatchet formation.

Looking at the different moving averages being used in the daily charts, it can be seen that the medium term and short term moving averages are looking to cross long term moving average and sneak above the long term moving average. Thus the overall scenario is looking good for a start of long term upward move. The lines are expected to cross around 1.4320 level adding to the importance of this level. The RSI in daily charts is just above 53 level and seems that it is also nicely placed for supporting an extended move towards 1.4580 level.