By: Colin Jessup

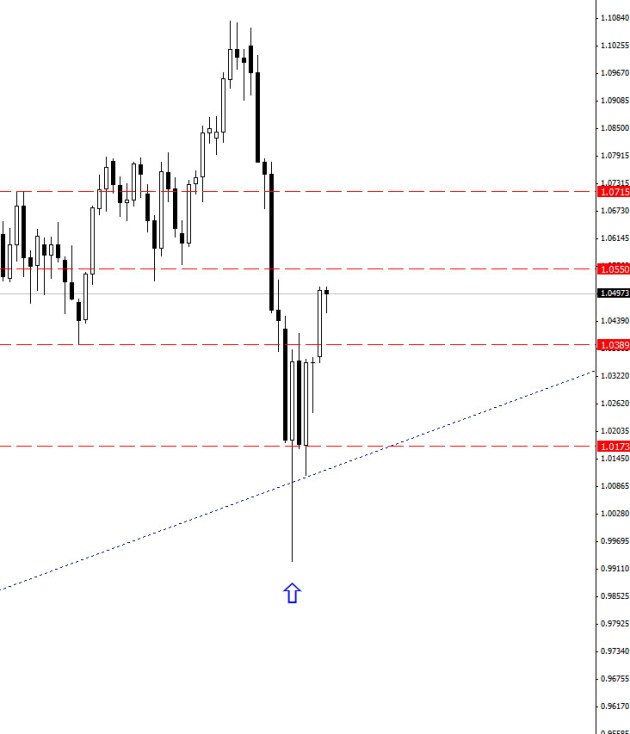

The Aussie has seen a positively bullish day. A strong session on local equities buoyed sentiment and assisted in underpinning the currency. During the offshore session, there was very little in the way of economic data and the moves for the Australian Dollar were largely sentiment driven which saw price action move above 1.050, by the end of the session. This comes as no surprise to technical traders as price reacted to a ascending trend line at 1.0100 and support at 1.0173. We have an immediate support zone at 1.039 on the daily charts with resistance at 1.0550 expected. On the bullish side we can expect price to move into the 1.069 area should it remain bullish, but look to sell if price drops back below 1.010. Placing a Fibonacci tool from the high to low of the last 3 weeks we also find ourselves at the 50% retracement level. Today’s release of the RBA August policy meeting minutes will provide further interest rate clues as markets continue to price in at least one cut over the remainder of 2011.

.jpg)