By: Colin Jessup

Well traders, its been a ho-hum trading week so far. Although here in North America we've only finished one trading day, there is a high probability that the whole week will be this way. There isn't much in the way of news until Friday, when the USA's GDP report will come out. There is also the possibility that Bernanke is going to release some QE3 info, for better or worse.

That being said, I want to remind you fellow trader, that FLAT is a position too. That's right, NO POSITION is A POSITION! So keep that in mind when days like this come along, and they do come along...if you are a trend trader you probably sit on the bench 70% of the time. If you trade short term this might not affect you quite so obviously, but it still affects your trading. One of a technical traders biggest foes is boredom.

So looking at today's chart on the EUR/USD doesn't tell us much other than confirm what I've already said, little market movement. That's okay, lets take a longer view of the same pair and switch to the monthly chart. Now its getting interesting! We have what some call triple tops, or descending tops which are basically successively lower peaks aka a descending chart pattern which typically suggests prices will trade lower and 3 of the last 4 months have indeed closed lower than they opened.

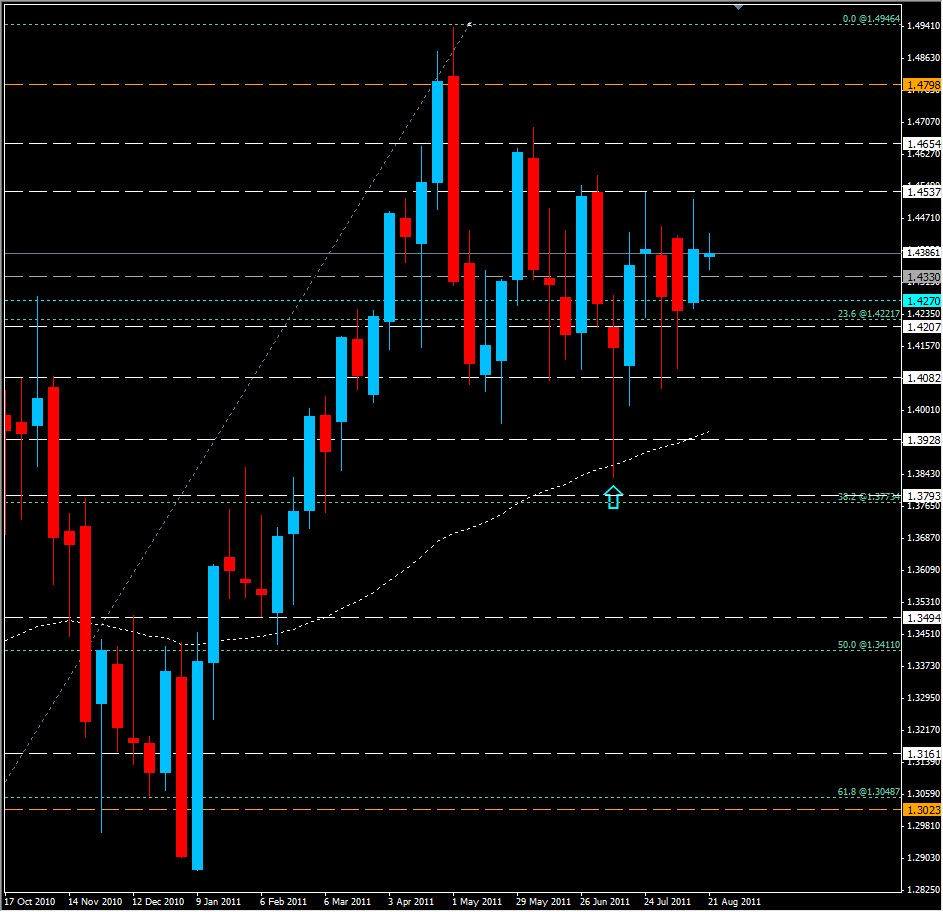

Dropping to a weekly time frame we see a Bullish flag pattern, which contradicts what we just saw on the monthly chart. However it does earn some support from the 62 EMA below it, also indicating price may remain bullish. Drawing a fibo from the low in June 2010 to the high in May of this year we see that the bottom of the flag bounced off of both the 38.2% level and the 62 EMA. This is also a bullish indication in my eyes.

At first glance of the daily chart it appears that it is just sideways...which is correct to a degree, until you back out to January of this year and see the same flag pattern we saw on the weekly chart is also present on the daily chart! So in spite of what the monthly chart indicates, we may be setting up for another bullish run. If price breaks above 1.4510 we will break through the descending trendline forming the top of the flag and could see 1.4800 again. However, should price drop below 1.3950 the monthly chart will have won the battle and price could continue to drop. Typically, I look to a longer time frame for direction, and everyone interprets patterns slightly differently.