By: Sara Patterson

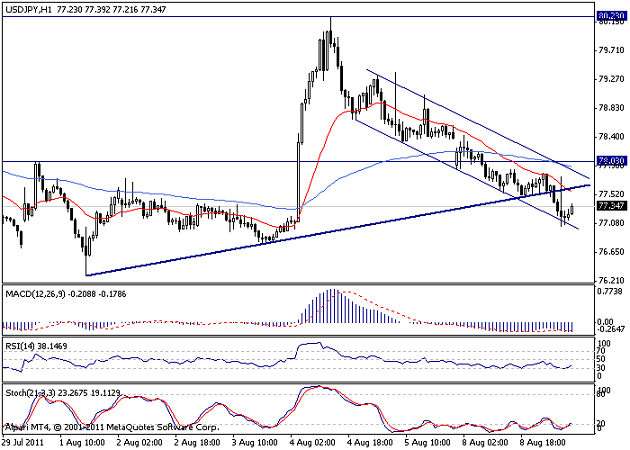

USDJPY: 77.32

Very Short-Term Trend: downtrend

Outlook: The past week's big rally, caused by a currency intervention, has been gradually retraced. The prices are back where they were before the intervention last Thursday. There's no question that this is another good example of the inefficiencies of interventions on the short-term charts. Now, the pressure remains on the downside and further weakness toward the 76.29 low is expected. However, the move down remains quite choppy and the market is still oversold. There is no immediately obvious low-risk entry at this point, but if you want to trade with the trend, then you should favor the short side.

The JPY tends to get stronger during economic and financial turmoil because Japan’s trade surplus makes it less reliant on foreign capital. Consequently, the currency reached 77.06 per USD in Asian trading today, matching the closing level on Aug. 3, the day before last week’s intervention that drove currency to as weak as 80.24. The yield on Japan’s benchmark 10-year government fell two basis points to 1.035 percent as of 1:46 p.m. in Tokyo, after earlier touching 0.975 percent, the least since November. Analysts are wary but speculate that the Japanese economy can't move much lower.

Strategy: Stand aside.