BY: Mike Kulej

Perhaps more than other crosses, pair of the commodity currencies go through more periods of consolidation. That happens because they often respond in a similar fashion to certain fundamentals, so their interactions during those times can be very boring. However, when those conditions end, pairs like the AUD/CAD can move as much as others.

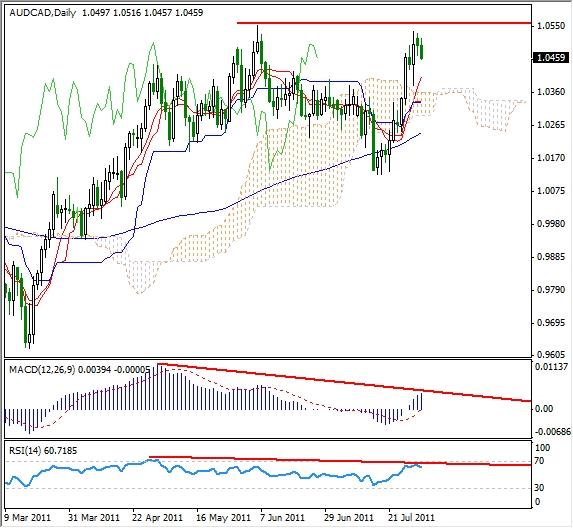

This pair became more active in the past couple of weeks. Prior to that, the AUD/CAD had been moving mostly sideways, with a downward slant. The price found support just under the 100 SMA, at 1.0125 and rallied strongly to 1.0532, almost testing the previous high of 1.0554.

This development sets us a possibility of a double top reversal pattern. Some technical indicators, notably the MACD and the RSI are diverging from the price. Of course, these divergences are not valid unless the AUD/CAD actually makes a new high, or at least touches the last high of 1.0554.

That could create a double top and a potential good selling opportunity. In that case, we need to see a bearish reversal candlestick, like a shooting star, a doji or perhaps an engulfing line, that might start a move down to at least the 100 SMA. For the moment, it is speculative, but worth watching for.