By: Colin Jessup

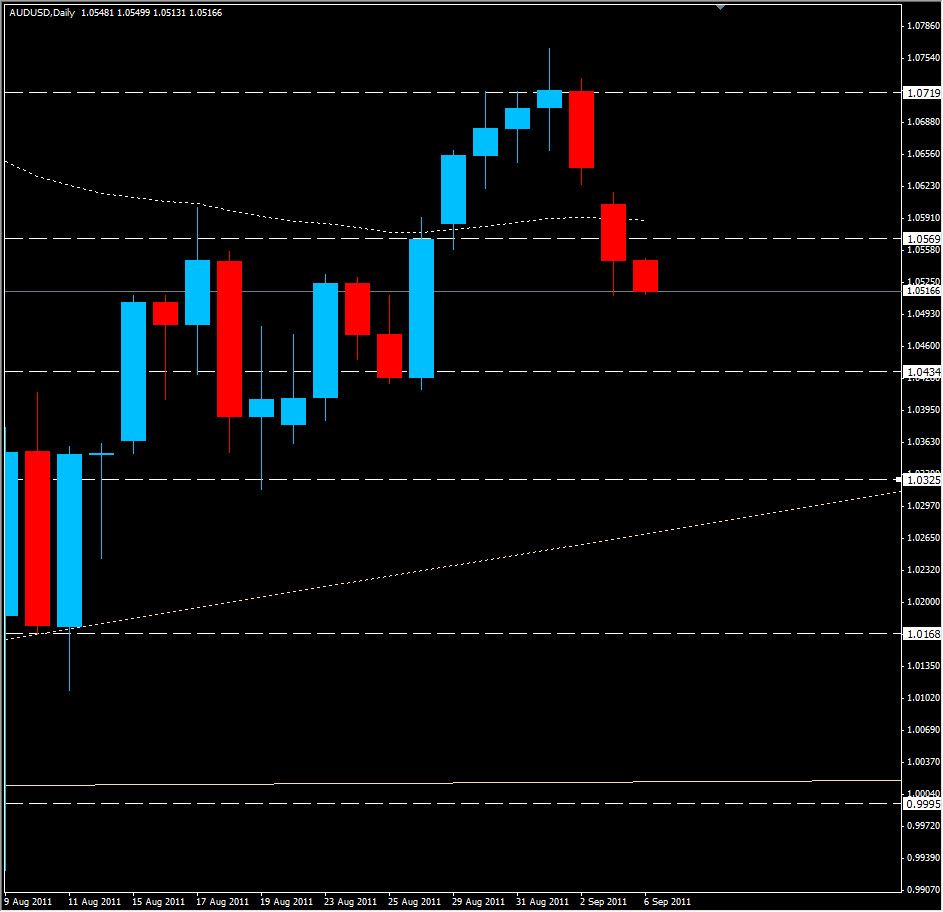

From a strictly technical point of view the pair known to some as the 'Pacific Peso' or Aussie is clearly bearish on a daily candle chart. We have both closed and opened under the moving average as well as closing and opening below a major support zone at 1.0560, with support at 1.0500 below us. If price continues to fall, look for support at 1.0434 area. Price will have to trade back above 1.0575 if the sentiment is to change from bearish to bullish, and if so will find resistance at 1.0650 and 1.0700.

With the RBA Interest Rate Decision looming it would be prudent to stay out of any position until the news has been released. If the RBA is optimistic regarding the Aussie economy, and increases the interest rates we should see the pair turn bullish. The flip side of this of course is that if the RBA is pessimistic about the Australian economy and keeps the ongoing interest rate, or lowers the interest rate, the bears will have more energy and push the pair lower.

While the RBA is the biggest of the announcements coming out of the land down under today, we also have July Home Loans, Current Account Balance and the Monetary Policy Statement being released.

Happy Trading!