By: Doug Rosen

The eurusd is currently at support over several timeframes. On the daily we broke the 233 ema, we are slightly outside of the bollinger band and stochastics is within the oversold zone. Price has also travelled quite a distance from relevant ema's and now that it is outside of the bollinger band it has to get back in. Price also needs to give the ema's a chance to catch up a bit.

Looking at the 4 Hour chart we are still within the bollinger band yet price did poke it so a bounce would be expected. As with the daily chart price has moved swiftly away from the ema's and the stochastic is also in the oversold zone.

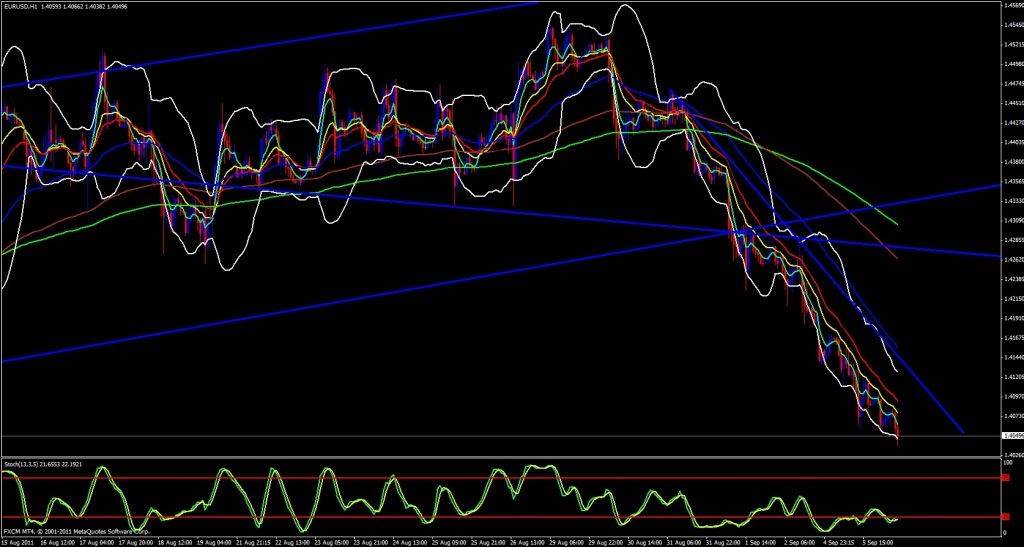

Moving over to the 1 Hour we have been gliding gracefully along the ema's and also within the bollinger bands yet the stochastics is also in the oversold zone. Taking all this in consideration I am still very bearish on the eurusd but I cannot ignore the fact that we have hit various support zones and are no doubt due for a retracement due to profit taking. We are still in the range the eurusd has been trapped within for the last several months but at the very bottom. With this in mind, the fact we are sitting just above last month’s low, also sitting on the weekly S1 Pivot and yesterdays low, I would expect a bounce to the upside for just a bit. I think some traders are taking profit and I expect to see the eurusd rise to 1.4110 area before continuation to the downside. At that point I will wait to see it either bust that level and keep heading back up or heading down and break support. If price 1.4050 I think it will keep falling without much fight to 1.4.