By: Christopher Lewis

The EUR/USD pair gapped lower during Asian Monday morning trading as the EU officials didn’t come to any type of conclusion for the ongoing Greek crisis. In fact, it appears that the leaders in the EU aren’t necessarily pressed about the issue. This shows a certain amount of inept governance as the rest of the world is very concerned about the Euro and in the currency markets – confidence is everything.

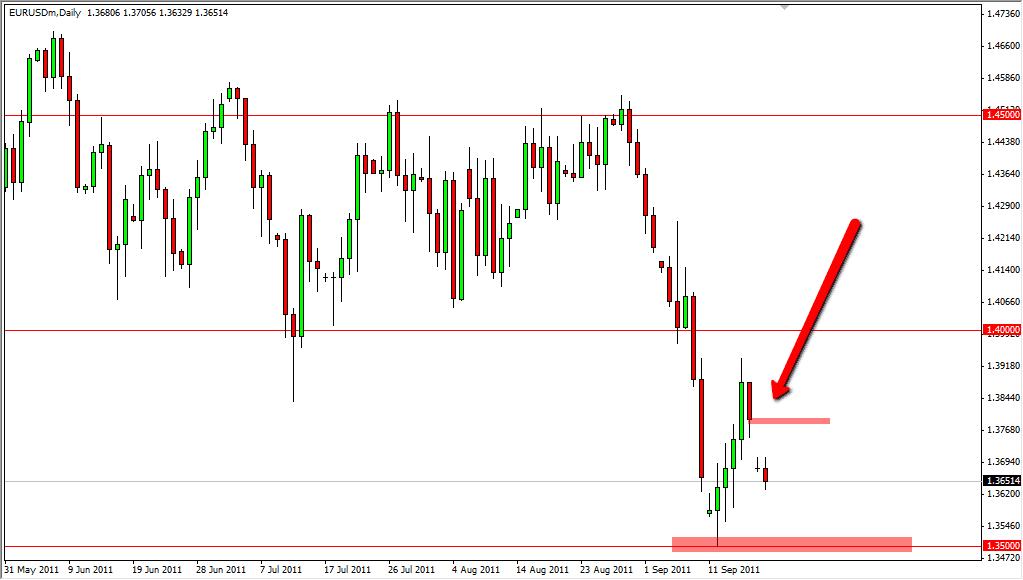

The EUR/USD fell right away, and is comfortably below the 1.37 handle during the New York Monday morning session. The pair has been on the back foot lately, and this fall looks set to continue as the 1.40 was once massive support, it appears to be the cap to any gains in this pair. The 1.35 was support last time we fell, but the bounce we had in this market has already been turned around in short order. Adding to the significance of the 1.40 area is the fact that it is the 50% retrace of the most recent fall.

The real question this week will be the 1.35 level, and whether or not it holds. The EU has a lot of issues at the moment, and with the Finance Ministers seemingly not interested in doing anything quickly, there is a real chance that the Euro may get punished in the meantime. The pair certainly looks like a “sell the rally” market at this point in time.

While the USD certainly has its own problems, the issues in Europe are at the forefront presently. It will never matter what’s worse, rather what is in the focus of traders at any given moment. It is because of this that the EUR/USD will remain in a bearish tone, but could have choppy trading going ahead. We see the 1.35 mark as a signal to fall even further if there is a daily close below it, and it will bring 1.30 into sight. At this point in time, we are struggling to see a reason to buy this pair, at least until the Finance Ministers of Europe get their collective acts together.