By: Christopher Lewis

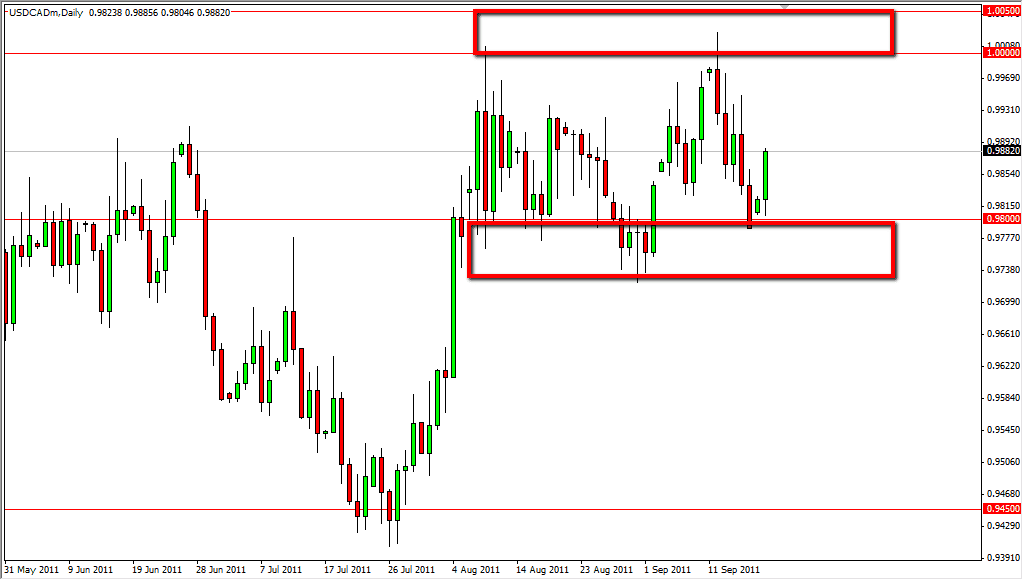

The USD/CAD pair has been stuck in a range between the 0.98 handle and the parity level for several weeks now, and at the start of the week, it appears this trend will continue. Although the overall trend is down on the weekly and monthly charts, the pair simply cannot find any selling strength other than to hit the bottom of this range.

The USD/CAD has fallen to 0.97 at one point, but this only confirms the strength of support as it appears to have carved out a 100-pip support level for the pair, and it shows just how hard it is to break this pair down. The parity level saw prices rise as high as 1.0025, but then were turned around again. The pair then seems a bit “stuck”, and if you understand the dynamics, it makes sense.

The Canadian economy is one that is definitively attached to the US economy. The most recent figures state that Canada sends roughly 75% of its exports to the US, and as a result the strength of the US economy greatly affects the Canadian one. For example, the US housing market demands a lot of timber. (When healthy) The majority of all wood used in construction is from Canada. Another product that is exported to the US is oil, and in mass amounts. The buying of it from America will send money from the US to Canada. This of course will bring the value of the USD/CAD down over time.

However, recently we have seen a massive flight from Europe and other economies around the world. The creates a sense of “safe haven” status in North America as it is far away from the banking and debt issues in places like the EU. However, as the global economy looks fairly weak, there will be less demand for oil and timber, as well as some of the other commodities that Canada is known for selling. We also have the debt issues in the US and the lackluster performance of the American economy at the same time. This is causing a sense of apprehension in trading the USD/CAD pair, and as a result will have it spinning its wheels for the time being.

The signal for this pair that is coming could be massive. A daily close above the 1.0050 level would be massively bullish for this pair. If the market closes on a daily candle below the 0.97 level, we could see a run down to the 0.9450 level again, and perhaps even beyond. Of course, the oil markets could dictate this as well. If the Light Sweet Crude prices get above $90 on a decisive move, you could see money flowing from the US into Canada, sending this pair down. For the time being, it is best to keep this pair on your radar as it consolidates quite often, but will have sharp moves once it breaks out of a zone. This time will be no different.