By: Christopher Lewis

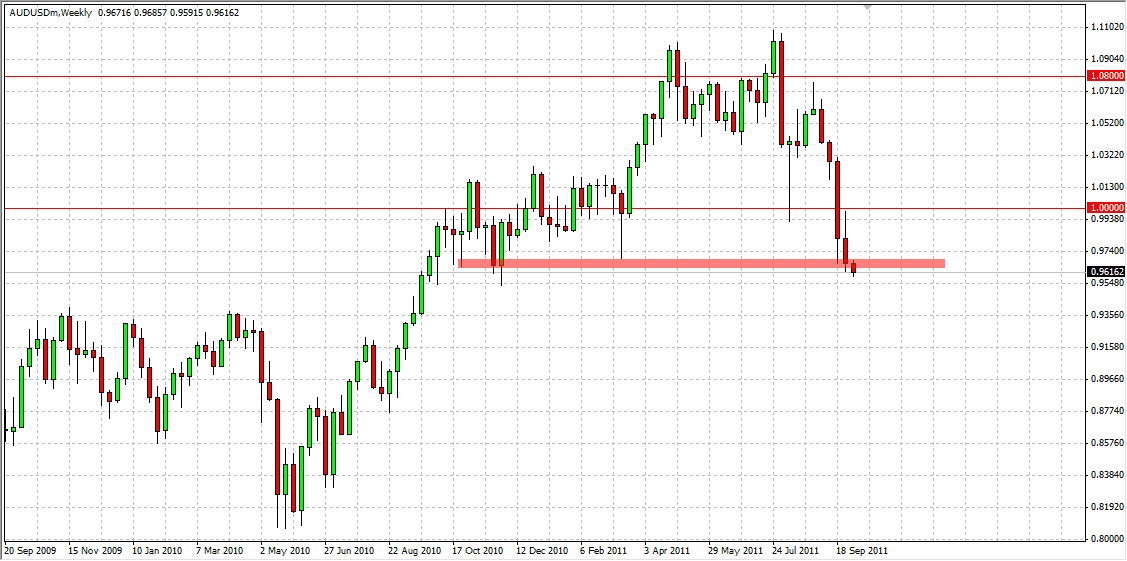

The AUD/USD pair has broken below the critical 0.9650 support level during risk-adverse markets. The pair has been falling rapidly, and as a result approached the level with lightening quick speed. The release of the Chinese PMI numbers over the weekend was a slightly bullish scenario, but with the world focusing more on the US and EU, China would have been hard-pressed to reverse the course of this pair.

Once parity gave way, the writing was on the wall for this pair. The rise of the Aussie has been relentless over the last couple of years, and the fall could be just as rapid. The Aussie is considered a “risky” currency, and as such will be dumped in times of fear and uncertainty. The commodity producing countries are especially hit hard when these times happen, as slowdowns in the economy mean that fewer raw materials will be needed in areas such as construction, manufacturing, and electronic devices. With Australia producing a lot of copper and other minerals, the thinking is that less will be bought, so there will be less demand for the Aussie dollar as a whole.

Looking at the chart, you can see that the 0.9350 area is the next major signs of support in this pair, and if it can sustain this down move, it should find that area to cause a reaction. If it gives way – this pair could fall much, much further as the move would certainly get compounded. Looking at a possible upside move, the parity level should continue to be massive resistance in the cross, as those “even” levels always seem to produce a reaction in Forex.

With the world slowing down, the outlook for the Aussie is bleak at best. The AUD is the first currency to benefit from economic acceleration, but unfortunately for the Aussie, traders will sell first, and ask questions later if the economy looks sluggish, or even bleak such as now. With the AUD being the kind of currency it is, odds are that events in the EU will dictate the course of the Aussie more than events in Australia.