By: Fadi Steitie

If we take a technical look at the weekly EUR/USD chart using Ichimoku averages, we still notice a negative bias expecting a drop in the trend due to the following reasons:

1- Trend broke the support line.

2- Tenkan (Blue) 9 days crossed Kijun (Red) 26 days on 13 Aug 2011 and the

trend fell into Kumo (Cloud)

3- Triple Buddha shape (Notice last head is below Kijun-sen (Red)

4- Chikou (Black) past 26 days is pointing toward a major resistance.

I do expect another corrective wave taking the trend down inside Kumo.

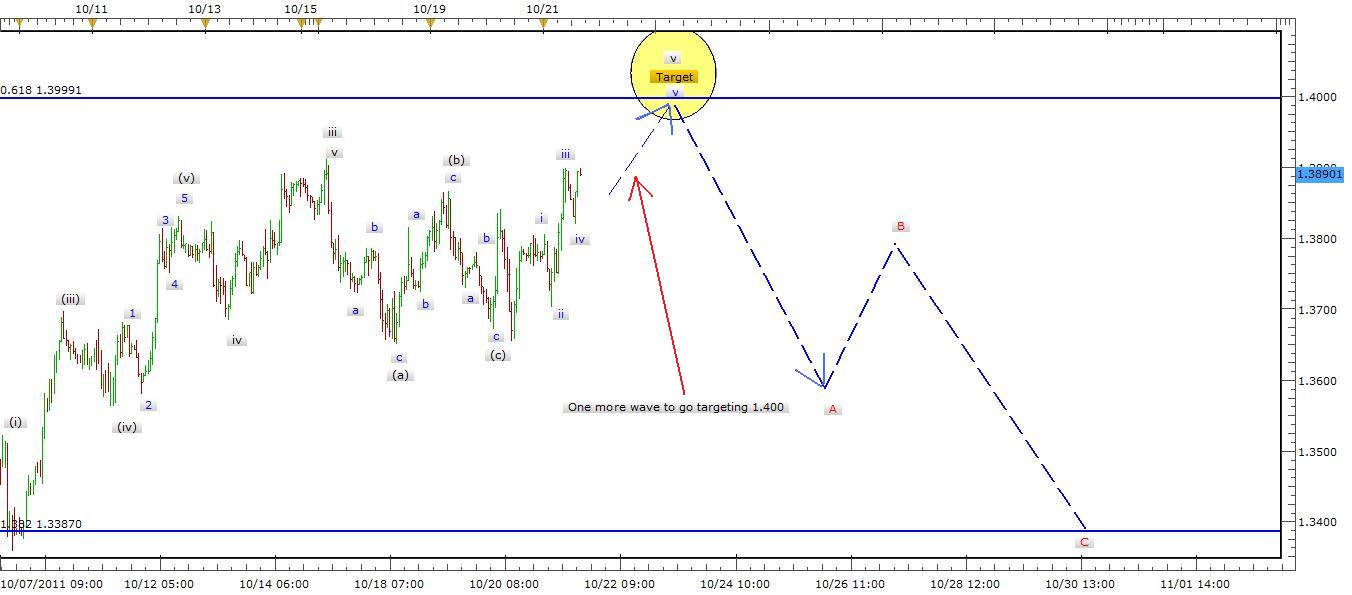

Below if we take a look at hourly chart using Elliott waves and Fibonacci we can notice the following:

Motive trend is approaching 0.618 Fibonacci level by unfolding the final minor wave v and from here I expect a drop in trend from that point 1.4000 level so I suggest the following trading strategy:

Signal: Sell at or near 1.4000 (I would suggest to wait till price bounce from that price point).

Strategy: Elliott Waves

Description: Trend is reaching 0.618 Fib level with a complete wave v which alert to an end of a trend and start of a new corrective wave expecting ZigZag.

Target: I will leave the target open until waves i through iii get the shape.

Stop Loss: 1.4100