By: Fadi Steitie

If we take a technical look at the Weekly chart GBP/USD using Ichimoku

averages, we still notice a negative bias expecting a drop in the trend

due to the following reasons:

1- Trend broke the support line.

2- Tenkan (Blue) 9 days crossed Kijun (Red) 26 days on 9 July 2011 and

trend fall into Kumo (Cloud)

3- A pull back in trend testing the new resistance before trend falls into Kumo.

4- Chikou (Black) past 26 days is pointing toward a major resistance on 23 April 2011 which indicate another resistance.

5- Chikou (Black) 26 days in the past has crossed Kijun (Red) which indicate a strong bearish view

6- Senkou spans have crossed 26 days into 52 days (Dead Cross) with another pull back testing Kijun-sen (Red) one more time before trend falls.

I do expect another corrective wave taking the trend down inside Kumo.

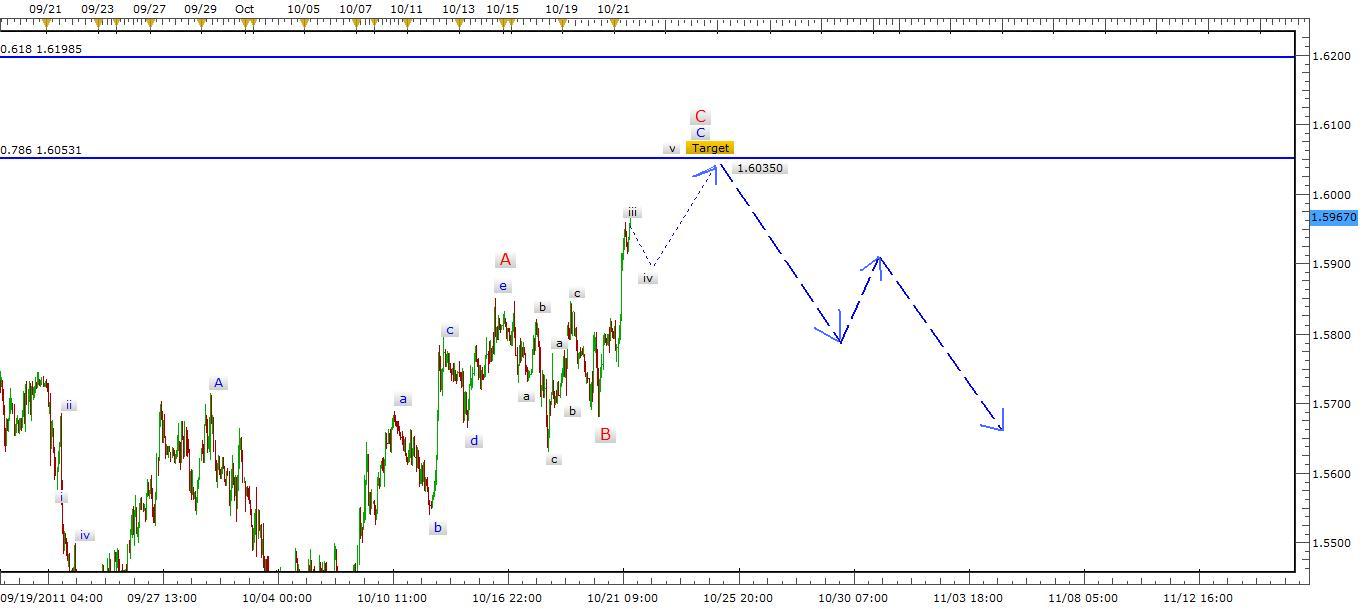

Below is hourly chart using Elliott waves and

Fibonacci analysis. we can notice the following:

Motive trend is moving toward 0.786 Fibonacci level by unfolding the final minor wave v. I do expect a drop in trend from that point

1.60530 level so I suggest the following trading strategy:

Signal: Sell at or near 1.60350 (I would suggest to wait till price bounce from that price point).

Strategy: Elliott Waves

Description: Trend is reaching 0.786 Fib level with a complete wave v which alert to an end of a trend and start of a new corrective wave expecting ZigZag, Flat or a motive wave (Options are open in this case).

Target : I will leave the target open until waves i through iii get the shape.

Stop Lose: 1.61350 and to be adjusted later once trend progress downward.