Trades Placed by optionFair

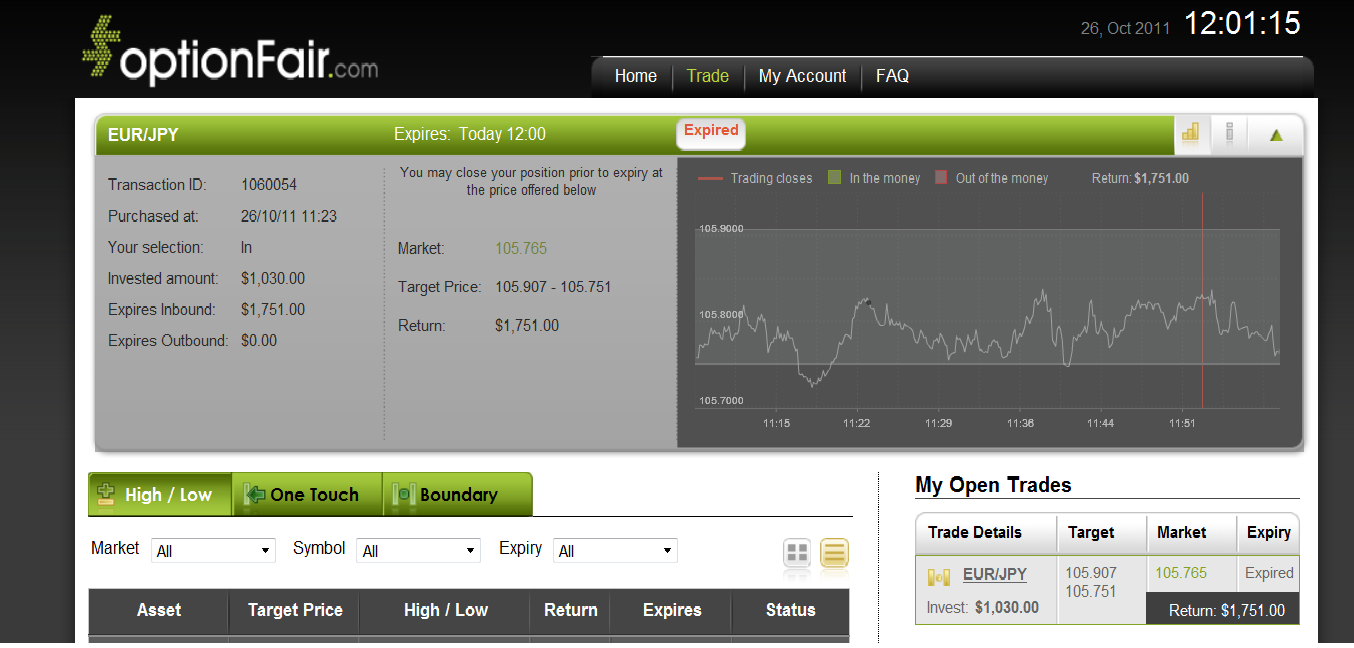

EUR/JPY

Based on Doug’s analysis, it seems that EUR/JPY is trapped in the middle of a range. The instruments that follow this pattern through and are suitable for the trade are “No Touch”, “No Touch Down” and “In”.

With optionFair™ Binary Options Trading Platform, I traded $1,030 on the “Boundary” instrument and chose the “In” direction. This kind of option has a return of 70% if the option expires “in the money”. I could get a return of $751 on my investment. The market price for EUR/JPY at the buying time (11:23) was 105.829 and in order for me to win the option, the market price should be below 105.907 and above 105.751 . The option expired at 105.765, which meant I earned $751.

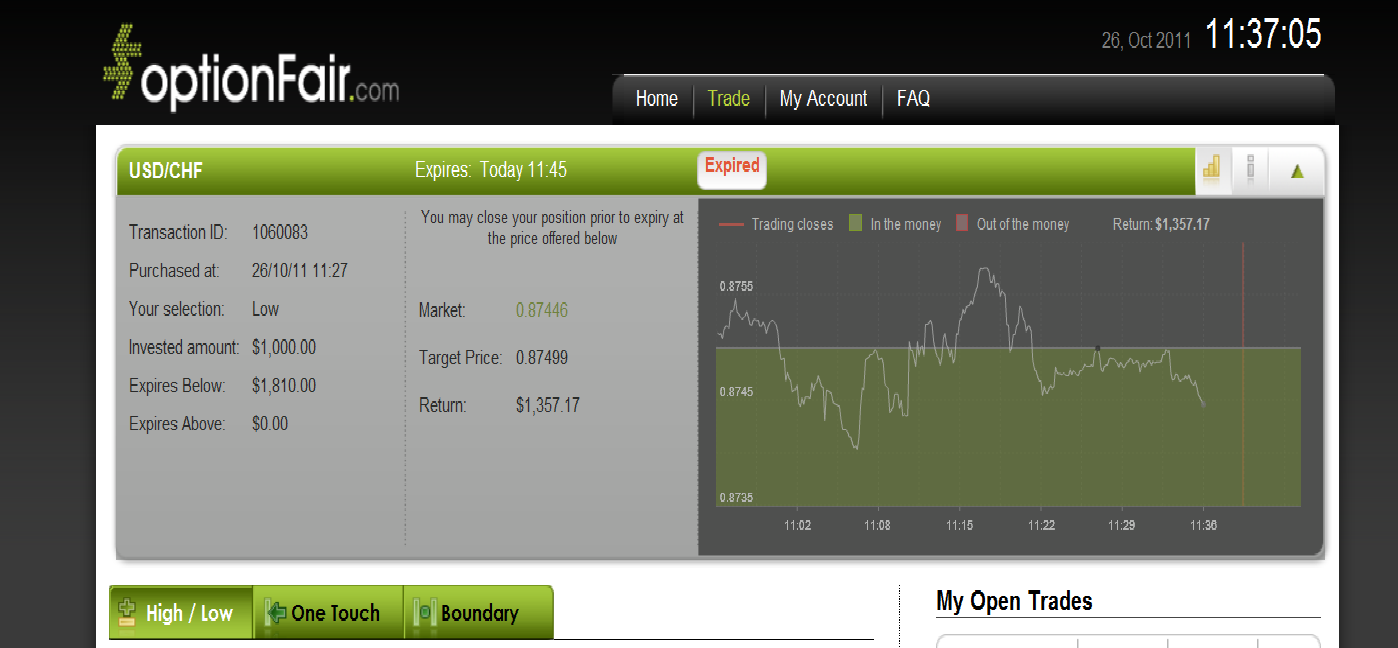

USD/CHF

Based on Doug’s analysis, it seems that the weakening in the USD/CHF creates an investment opportunity in the following positions: “Low” or “Below”, “Touch Down” or “No Touch” on the USD/CHF.

With optionFair™ Binary Options Trading Platform, I traded $1,000 on the ”Low” instrument. This kind of option has a return of 81% if the option expires “in the money”. I could get a return of $810 on my investment. The market price for USD/CHF at the buying time (11:27) was 0.87499 and in order to win the option, the market price should be lower at the expiry time.

Although the option was moving in the right direction, I chose to close the option prior to expiry time and collect some of the profits. In this particular case I earned over 35% of my profit in less than 9 minutes!