By: Christopher Lewis

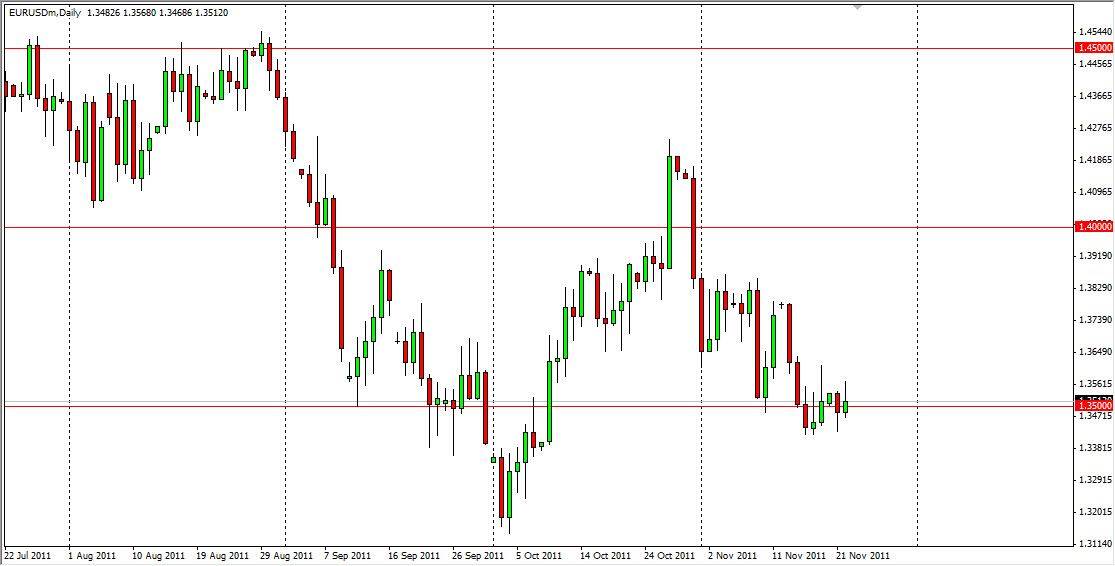

The EUR/USD has fallen quite precipitously over the last few weeks, only to slam into the 1.35 level. The area is offering support and is frustrating the bears as the pair simply will not give in at this level. In fact, if you watch it during the day, every time the pair falls to 1.3450 or so, there is buying that suddenly appears. Somebody doesn’t want this pair to fall.

The area shows support on the charts all the way down to the 1.31 level, and because of this I find this pair less interesting than most traders do at the moment. It is easy to get “sucked into the market” as it dominates headlines, but the fact is that the pair simply seems to be oblivious to all of the bad news that the talking heads on television are focused on. This is mainly because as this pair holds steady, stocks are getting pummeled, and that of course is what most people pay attention to.

What's Coming Next?

The next 400 pips to the downside are certainly going to be much more difficult than the previous 400. It is because of this that I am playing the downside risk trade in the form of the commodity currencies, since they don’t seem to have the ability to defy gravity at the moment. With this in mind, I am watching the Euro, and as a result will be aware of what is going on, but am not expecting big things out of this pair in the short-term. Long term I think this pair goes to parity, but that could be years in the making.

The breaking of the recent lows in the 1.3450 area would be significant, but I have to conceded that the support underneath is still going to drive this pair more sideways than down for a while, and as such will be traded in the form of a short AUD/USD or NZD/USD trade in my case.