By: Christopher Lewis

The EUR/USD has plunged during the Wednesday session as fears of Italian debt problems continue to take the focus of the markets. With the Italian 10 year bond suddenly reaching the 7.25% level, the fear in the markets is palpable.

The charts show a massive bearish candle forming from the European sell off, and one has to think we are reaching an inflection point soon with the debt issues suddenly entering a much more dangerous phase. Greece was one thing, Italy is another.

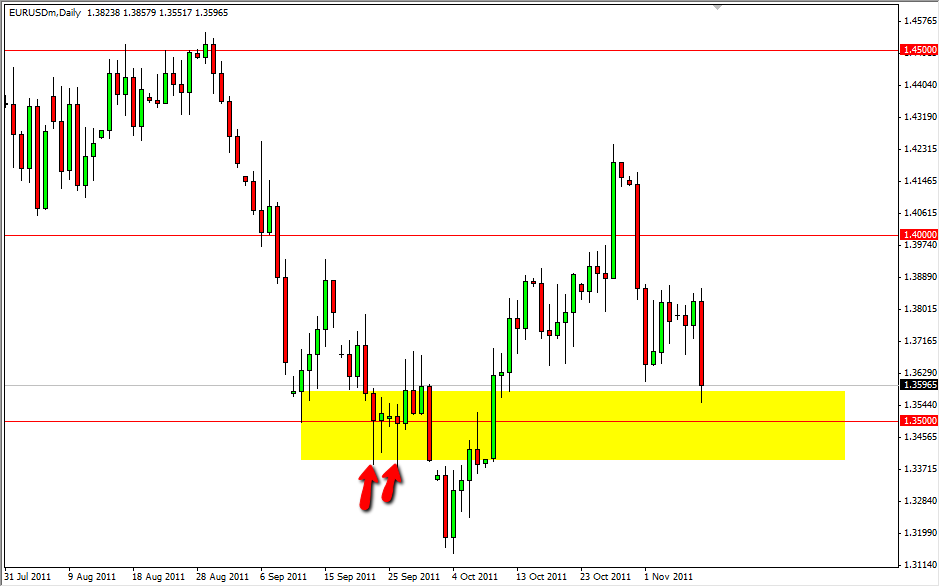

Looking at the move, you can see a yellow box drawn on this chart in the vicinity of 1.35. The area is just that – an area, and we see it as vital to determining the future move in this pair. The EUR/USD keeps managing to bounce every time it falls, but certainly it cannot do this forever. There is talk in the markets that perhaps there are Asian central banks in the area, but this can never truly be substantiated. None the less, you can clearly see how this area has come into play several times, and we see the need to break below the hammers in late August as shown by the arrows as the real signal that the last of the support has given way.

On days like this, it is very temping for traders to pile on, but with this area pointed out, we hope that traders will at least be aware of the possibility of a bounce, no matter how counterintuitive it seems. The markets don’t always make sense, and they don’t need to. You can only trade this chart as it presents itself and that it the point. While a bounce looks possible, buying the Euro seems to be a bad idea as well, as the headline risks are far too great. Selling rallies seems to be the way to go, judging from the recent history of this pair.