By: Fadi Steitie

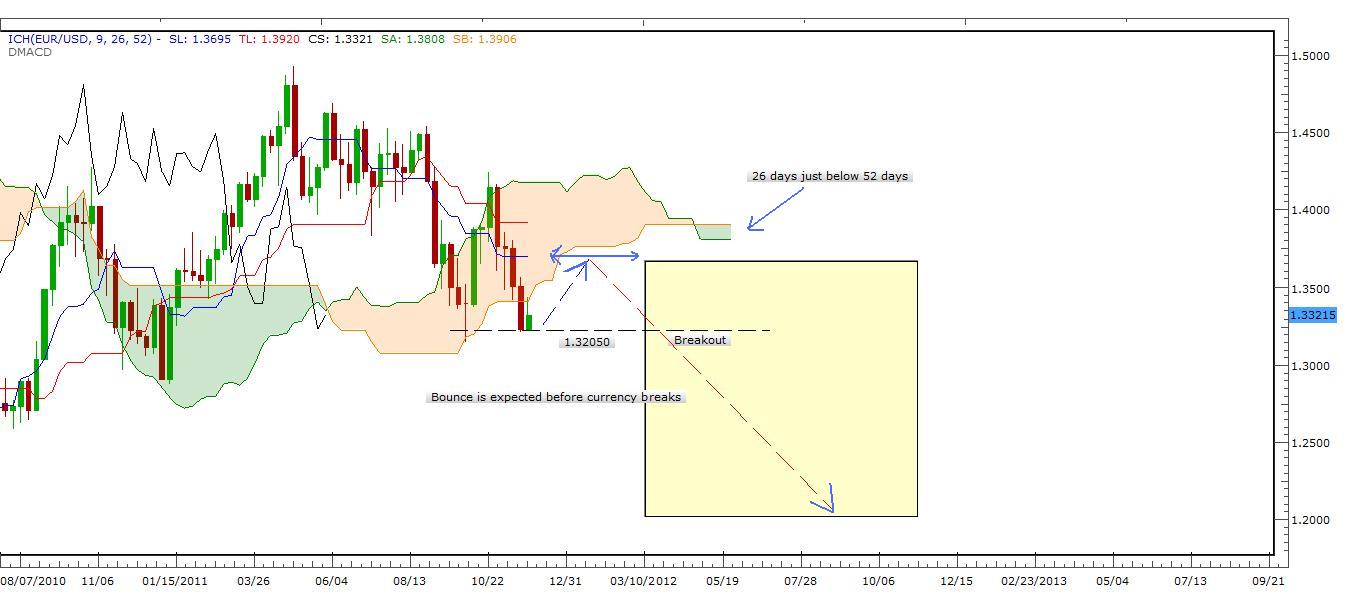

Currency: EUR/USD

Trend Expected Direction: Down

Strategy: Weekly Ichimoku Kinko and Hourly Elliott Waves and Fibonacci Trading.

Description: Trend has finally breaks the cloud Kumo hitting the Doji support which indicate a bounce is on the way for a day or two going toward 0.382 fib level as shown on hourly chart. I do expect a major drop once trend breaks 1.32050 heading downward. Again we can all notice how senkou A 26 days crossed Senkou B 52 days for a negative sentiment on weekly chart. I suggest a short strategy that I will send in a day or two or once more economic news flows in order to trade the negative momentum. A quick look at hourly chart, we notice a positive divergence between trend and rate of change. ROC changed from negative to positive once wave v reached 1.618 fib level. Double Zigzag completed upward so far and more complex waves are expected before trend falls.

Action: Hold and watch for breakouts

Target Area: N/A

Stop Loss: N/A

Risk: N/A