By: Christopher Lewis

The USD/CHF pair has been propelled by recent announcements out of the Swiss National Bank deploring the heightened value of its currency. The real culprit is the EUR/CHF, as Europe is Switzerland’s #1 export market, but the various Franc-related pairs will move in tandem as a result.

With this in mind, the obvious choice is to trade the USD/CHF market. The Dollar has the unique status of being the last true “safety currency” in this environment as the SNB will not allow the appreciation of the Franc in any significant way. The Yen would be a viable alternative, but the Bank of Japan has intervened to weaken it a couple of times recently. While the Bank of Japan is struggling to keep the USD/JPY pair afloat, the Swiss will find their job much easier as the market for the Franc is much, much smaller than the market for the Yen.

With this information in mind, the USD/CHF becomes an interesting trade. The EUR/CHF would rely too much upon the EU getting its act together, something that is likely to take a while. This is why you are seeing movement in the USD/CHF market, while the EUR/CHF has been flat as a general rule.

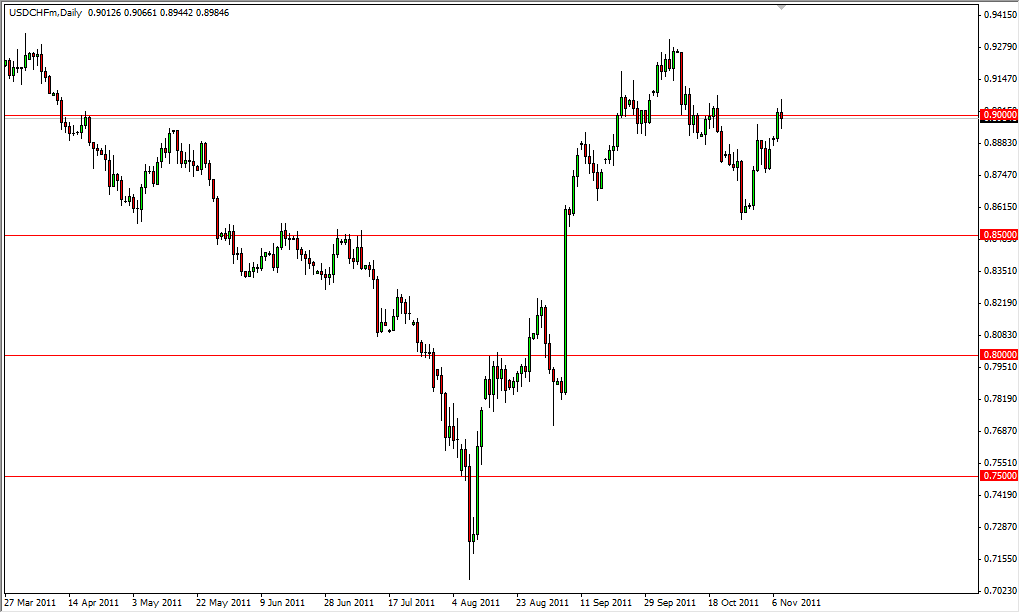

Looking at the chart, the USD/CHF is presently testing the 0.9000 handle, which we have as a major level of support and resistance. However, with the recent economic issues effecting the markets, it is hard to believe that the “safety trade” is going anywhere. The real test is whether or not the pair can close on a positive candle above the 0.9000 mark. If it can, it looks like the pair will run to test the recent highs in the mid-92 handle, and perhaps run onto 0.95 and parity.

There are also rumors flying around that the SNB may impose a new “floor” on the EUR/CHF at 1.25, or even as high as 1.30 or so. It could do such a thing looking at how the 1.20 floor has worked out for them. If they feel emboldened because of that, there will more than likely be a move before too long. Remember, the Swiss have been intervening in the EUR/CHF far above currently levels, and have massively losses as a result. This only propels the idea of Franc weakness, and Dollar strength as the pair has the advantage of a currency traders want in the USD.