Trades placed by optionFair

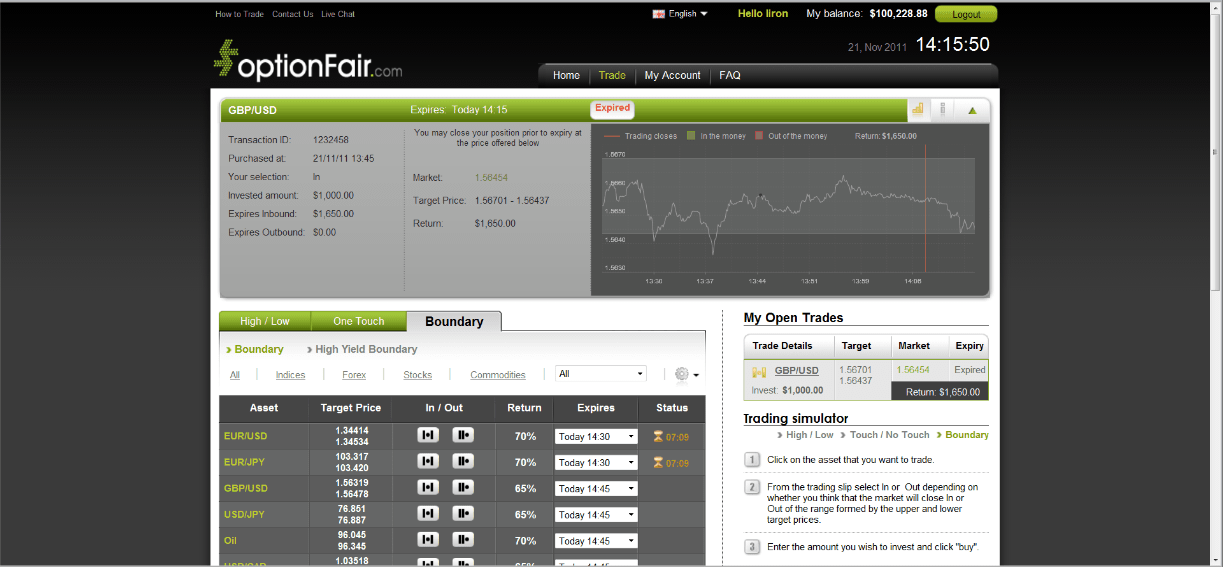

GBP/USD

GBP/USD is best traded on low volatility accorded to Doug’s analysis. Instruments that are sensitive to this behavior are: “Touch” Touch Down” and “In”.

I placed $1,000 on “In” at optionFair™ Binary Options Trading Platform, so that if this option expires “In the Boundary”, I will have a 65% return, or $650 on my investment. At the buying time, 12:42, the GBP/USD traded at 1.5693 and the boundary range was 1.56843 – 1.57023 for the expiration time of 13:15.The market expired at 1.56454 be-tween the boundary range, and I won $650.

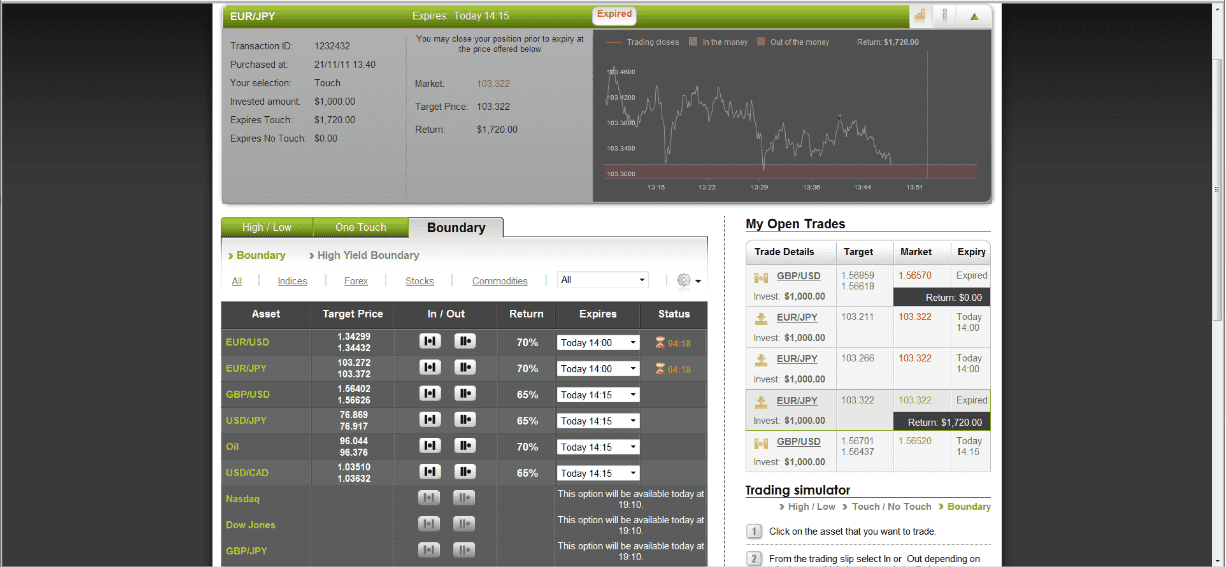

EUR/JPY

The EUR/JPY is more bearish than bullish according to Doug’s analysis. In other words, this means that a particular security, a sector, or the overall market is about to fall. Therefore it is recommended to invest in the following positions: “Low”, “Touch Down”, or “No Touch”.

I placed $1,000 on “Touch Down” at optionFair™ Binary Options Trading Platform with the understanding that touches the strike price prior to expiration, I will have a 72% re-turn, giving me $720 on my initial investment. The difference between the underlying security's current market price and the option's strike price represents the amount of profit per share gained upon the exercise or the sale of the option. This is true for options that are in the money.

At the buying time, 13:40, the EUR/JPY traded at 103.388 and the strike price was 103.322 for the expiration time of 13:48.The market was in my favor giving me a $720 win on my initial investment, in just 8 minutes.