By: Christopher Lewis

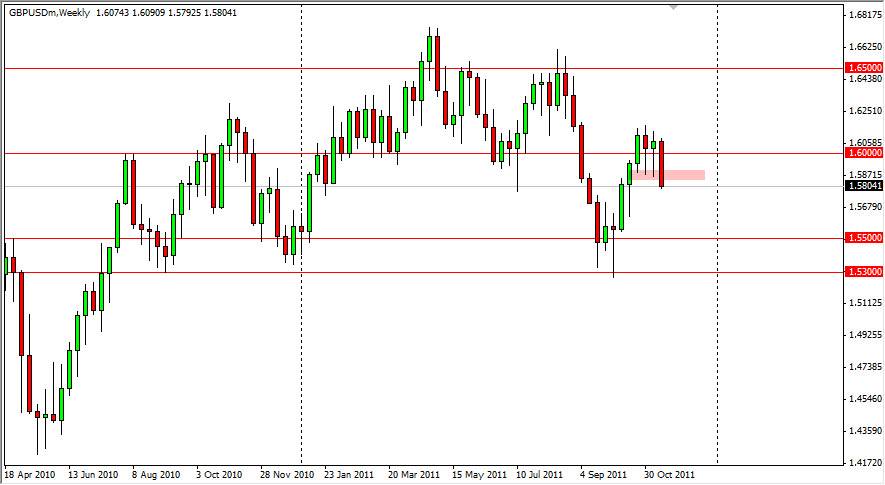

The GBP/USD pair has started to fall apart as traders have broken through the bottom of duel hammers on the weekly chart, which shows a real failure of support at this point. In fact, the duel hammers were considered to be massively bullish at one point, and the fact that they have been broken below shows a massive breach of strength in this pair.

The Dollar will continue to be bid as the world worries about recession and EU debt contagion issues. The Europeans owe a lot of money to British banks, and the UK economy could get the one-two punch of having loans defaulted on and the selling of the currency as the “safety trade” of buying Dollars comes back into vogue.

The 1.60 level was considered to be vital to the continuing rise in this pair, but the fact that the area has given way shows just how suddenly things have changed for the Pound. The pair is highly correlated to the world’s financial markets, so this could also be a bad sign for stocks. In fact, this has already come true in several emerging markets as the EM’s have been absolutely horrible when compared to the NYSE, NASDAQ, and other larger markets.

The run to the Dollar on bad headlines should continue to sink this pair, and now that the duel weekly hammers have been violated, selling rallies will more than likely be the standard for cable in the near future. Buying really cannot be done in this type of environment, which seems to be accelerating towards pessimism around the world currently. The 1.55 level below should be supportive, and there is even a “zone” all the way down to 1.53 that could offer support. However, the tone of the markets isn’t exactly conducive to risk-taking, and as long as that is the case, we should see a move south in this pair to find at least 1.55, and possibly even lower.