By: Christopher Lewis

NZD/USD

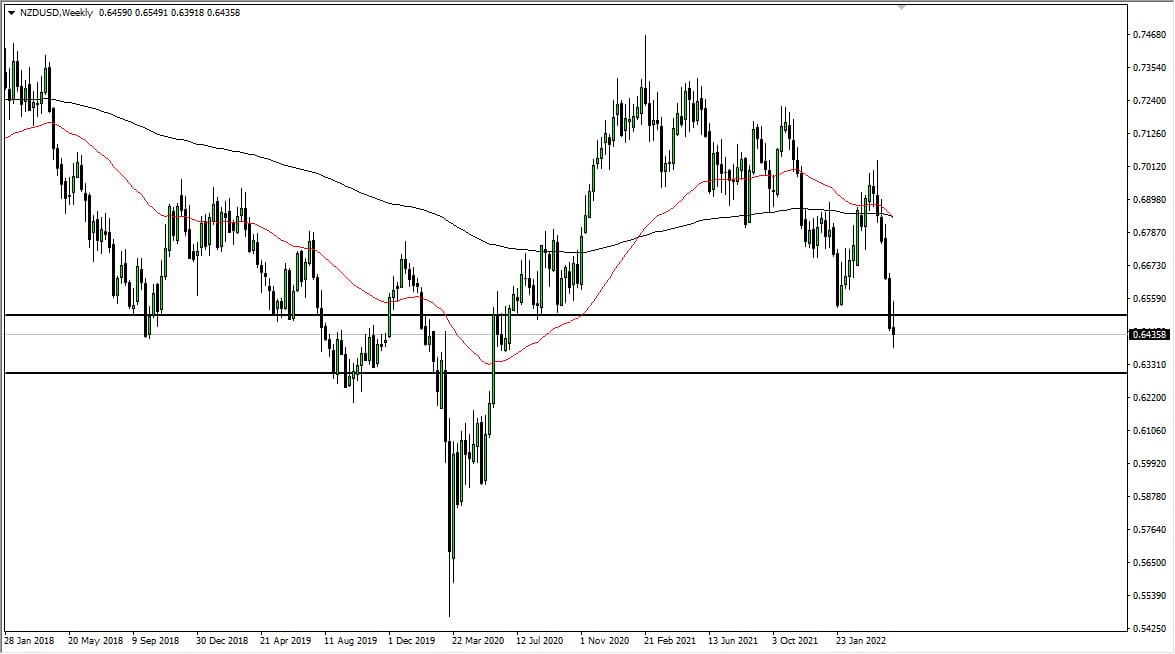

The Kiwi dollar had an absolutely horrible week over the previous 5 sessions, falling towards the 0.75 level. The area shows serious support potential, and looks like it will be the “line in the sand” for Kiwi bulls. The candle for the previous week did finish at the very low end of the range, so it seems fairly likely that the support will be tested thoroughly.

Kiwi dollar is extremely risk-sensitive, and as such will be at the whim of headlines yet again this coming week. If the 0.75 level gets broken, we will be entering an area that will be more of a grind than a sudden fall. (Barring any major shocks to the system that is.) We would expect continued downward pressure, and would be willing to sell rallies at this point, looking at bounces as potential selling opportunities. To short down at the current levels is trading into a real tug-o-war.

GBP/USD

Cable fell during the previous week, smashing through the bottom of the two previous hammers situation around the 1.60 level. This was a very bearish turn of events as it showed support failing. The Bank of England is expected to talk about more quantitative easing this coming week, and it should keep the Pound on the back foot. The end of the week saw a retest of the 1.59 support level to prove it as being resistive now. The pair should continue to find itself running towards the 1.55 level below.

AUD/USD

Much like its antipodean cousin, the Aussie found itself falling during the week, and then smashing into major support. In this pair, we find support at the parity level, and there looks to be a lot of it between here and 0.95 or so. Although the previous week’s hammer was violated, it looks as if any move down will be a grind and should expect a lot of fight form the bulls. If you are looking to trade the commodity currencies lower, you may just find the Kiwi a bit more agreeable this coming week.

EUR/USD

The Euro continues to be the eye of the storm during the debt crisis that we find ourselves in presently. Because of this, the pair will continue to be driven by random headlines, and could produce a lot of whippy conditions for traders. The pair fell to the 1.35 level during the week, and even managed to break the bottom of a hammer form the week before. This is a very bearish signal, but it should be noted that it appears that this pair has “9 lives”, as every time we get a serious move down, there seems to be buying at 1.35 or so. (There is a lot of chatter in the marketplace about Asian central banks buying Euros for diversification presently, and that 1.35 seems to be attracting them.)

No matter the reason for this pair staying afloat, you simply cannot ignore the fact that at the slightest hint of good news – this pair shoots straight up. Because of that, it is going to be considered the most dangerous pair to trade at the moment. However, rallies can be sold off as well, as that strategy continues to work. The area we are in presently is far too supportive to sell into however.

.jpg)

USD/CHF

USD/CHF continued to grind higher over the last week, and looks set to attempt a new swing high. It is at this point a trend change would be technically confirmed, and that the pair becomes a “buy only” scenario. The breaking of the 0.93 (roughly the swing high) area has the pair looking for 0.95, and possibly parity before too long.

The Swiss National Bank is actively working against the appreciation of the Franc in general, and the USD is the last remaining “safe haven” currency out there. With the numerous headline risks out there in the markets presently, it makes perfect sense for this pair to rise.