By: Colin Jessup

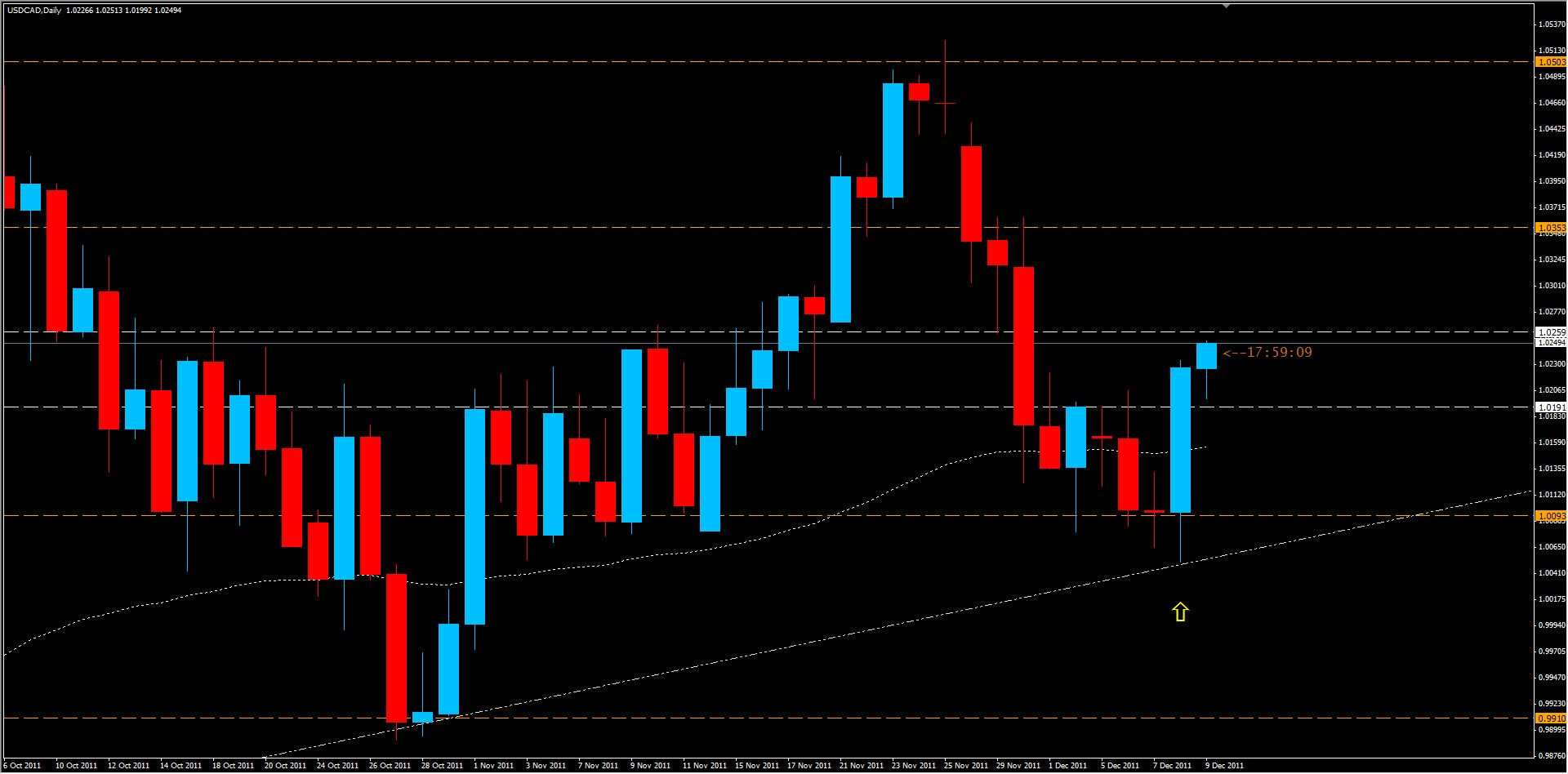

The USD/CAD has reacted off of the weekly support zone at 1.0093 with bullish tendencies and is now attempting to push higher. At time of writing, (about 1pm Tokyo time), we see the loonie pushing as high as 1.0257 and appears to be trying to keep the bullish momentum from the USA session going. However, we have a daily resistance zone at this very level and this could be the fly in the loonies ointment, so to speak. Quite often prices move in the opposite direction during the Asian session than they do during the USA or UK sessions and I see this as an indicator that the daily zone of 1.026 could hold, and trigger a retracement or even a reversal. That said, yesterday's high was 180+ pips higher than its open, which is a significant move for any currency. This is a bullish engulfing candle that completely engulfed the last 5 daily candles and is usually seen, especially when forming on a strong support zone, as an indication of higher prices to come. So what can we expect? Well, look for price to break above 1.0260 to remain bullish and shoot for the next weekly resistance zone of 1.0353 or even a retest of November's high at 1.0523. If price does not break & hold above 1.026 I would expect it to retrace to at least 1.015 or even test 1.009 again.

Happy Trading!