By: Christopher Lewis

EUR/USD

The EUR/USD pair looks to continue the back and forth motion as the debt crisis churns on. The pair has seen quite a bit of support in the 1.31 – 1.35 area over the last two months, and every time this pair reaches that area – it gets a bounce. The pair is roughly in the middle of the downward channel on the monthly chart, and the pair is somewhat in “no man’s land”, but the headlines will of course continue to push it around. The 1.35 – 1.40 still looks to be where this pair is most comfortable, and it we truly are getting a meltdown in this pair – 1.30 will have to be broken below.

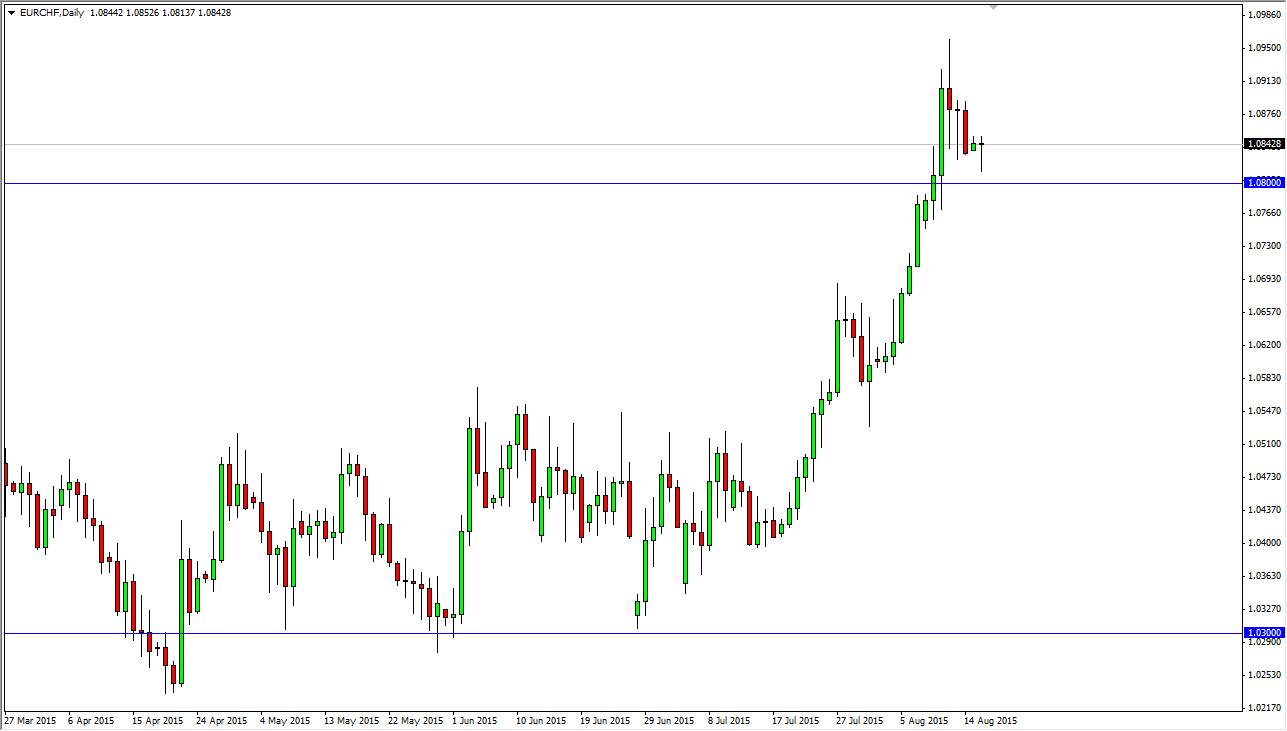

EUR/CHF

The EUR/CHF pair continues to sit in the vicinity of 1.23 as the last two months have produced very little in the way of volatility. The equation for this pair is quite simple: If the EU can get the debt crisis taken care of, the pair rises. The real trigger would be a breaking of the very obvious 1.25 resistance area. If this pair can overcome it, the long-term buy can be done in this market. 1.20 is the floor, so selling is very difficult until the Swiss stop fighting the appreciation of the Franc.

AUD/USD

The Aussie has been banging around the 1.06 – 0.95 range for the last three months roughly. The pair is bullish in the long-run, and the fall last month was yet again pushed back up. The pair should continue to be volatile, but the ranges simply look too strong to be broken. At the 0.95 level this pair continues to be a strong buy as the Australian economy is still the “general store” for China.

GBP/USD

Cable looks like a range bound pair with an upward bias on the monthly charts presently. The 1.53 level seems to be the “line in the sand” for bulls, and each time we get anywhere near it – the pair gets bought. This should continue into the foreseeable future as the spot has been so strong in the past as well. The pair would be a massive sell if we can get below 1.53, but until then will continue to be buoyant.

USD/CAD

USD/CAD continues to consolidate between 1.06 and parity. The pair has more of a downward bias, and being in tune with the trend it makes sense. The one thing should keep in mind: The bottom support used to be at 0.9450, and has risen to parity over the last couple of months. If the economic situation continues to deteriorate, this pair could absolutely skyrocket. The 1.07 level is a massive barrier, and if it can be overcome – 1.12, 1.18, and 1.30 could possibly be targets.

.jpg)

.jpg)

.jpg)

.jpg)