Trades placed by optionFair

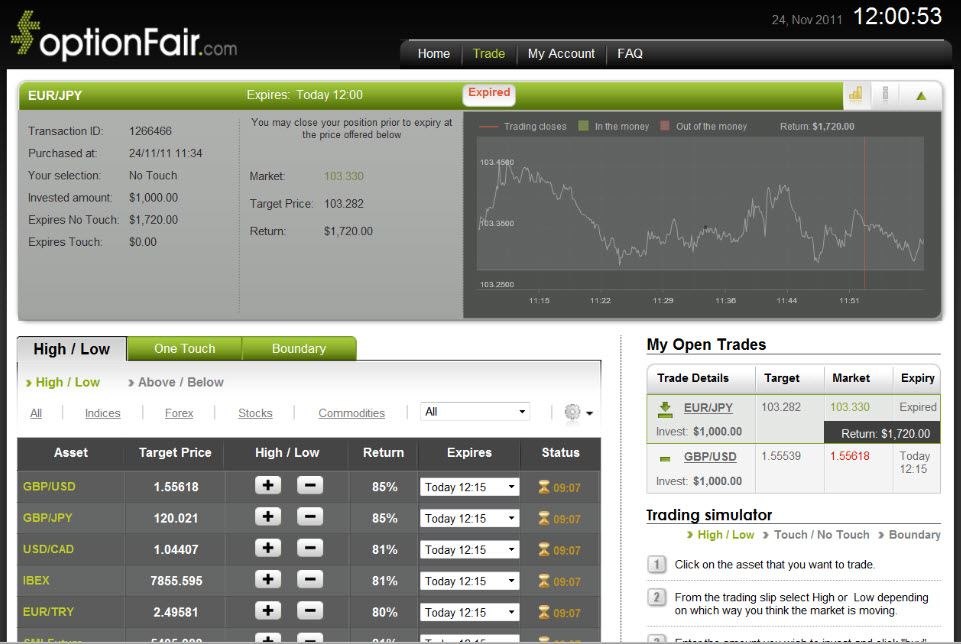

EUR/JPY

Based on Doug's analysis the EUR/JPY is traded on low volatility. Volatility refers to the amount of uncertainty or risk about the size of changes in a security's value. A lower volatility means that a security's value does not fluctuate dramatically, but changes in value at a steady pace over a period of time.

The volatility sensitive instruments are: “In” and “No Touch”.

I placed $1,200 on the Boundary instrument and chose “In” at optionFair™ Binary Options Trading Platform. If the option expires “In the boundary” 104.887 – 104.757 in this case, I could get a return of $840 on my investment as this options has a 70% return rate.

At the buying time, 12:10, the EUR/JPY traded at 104.824 and it expired at 12:30 with the boundary range between 104.887 – 104.757. The market expired at 104.860 which is between the boundary, giving me a $840 on my initial investment.

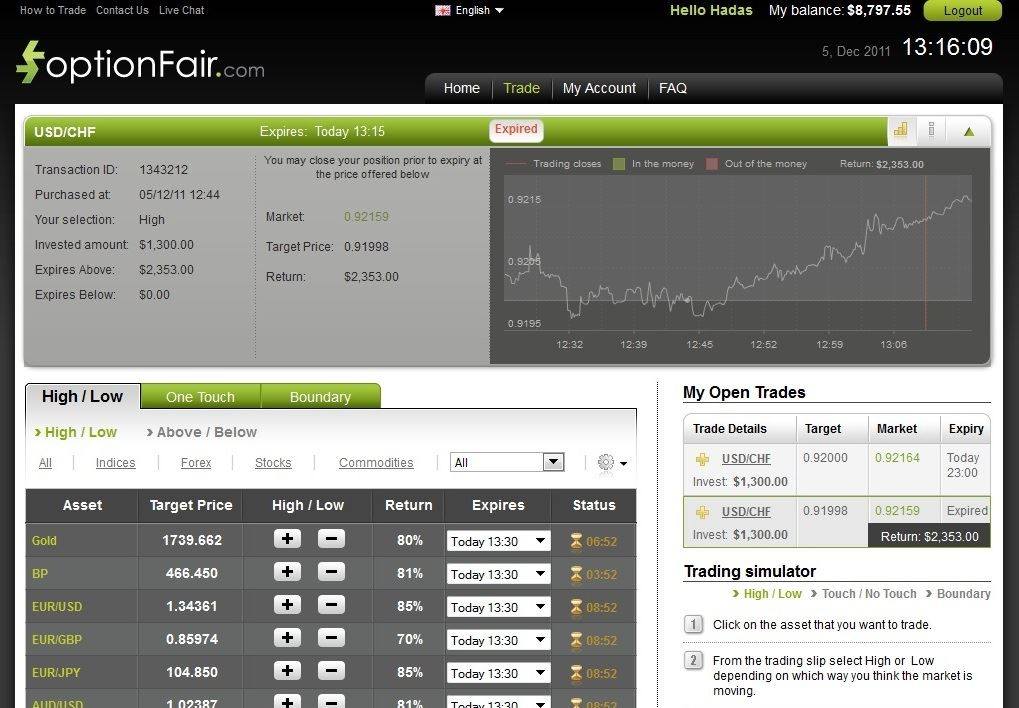

USD/CHF

The USD/CHF is showing bullish behavior according to Doug’s analysis. In other words, this means that a particular security, a sector, or the overall market is about to fall. Therefore it is recommended to invest in the “High” position.

I placed $1,300 on “High” at optionFair™ Binary Options Trading Platform at the buying time, 12:44, the USD/CHF traded at 0.91998 and the strike price was 0.92159 for the expiration time of 13:15 which is 16 pips above my target price. The market was in my favor giving me a $1053 win on my initial investment. A great sum of money for just over 30 minutes of trade.