By: Christopher Lewis

EUR/USD

The EUR/USD pair found itself falling all the way down to the 1.30 level over the previous week as the world continues to worry about the issues in Europe. However, the level is the start of a massive support zone that is roughly 100 pips thick. The area will be very difficult to break through, so a bounce is probable at this point in time. The pair still is very bearish overall, so these bounces will more than likely turn out to be nothing but selling opportunities going forward. Ultimately, the level will give way – but only after sustained negative pressure.

AUD/USD

The AUD/USD has managed to slip below the parity level over the last week. The last four trading sessions have all seen attempts at rallying, but each session has ended up with a long wick showing failure. Most interesting is the candle from Friday as the shooting star was formed showing failure to stay above the parity level. The pair looks like there are plenty of people willing to buy, but the power just isn’t there. There is a gap from two weekends ago down at the 0.97 level that has yet to be filled. One negative headline is what it will take to see that dad air retaken. Any rallies are to be viewed with suspicion.

USD/CHF

The USD/CHF pair has had a nice run to the upside recently, but has seen selling over the last two sessions. The main reason for this was the lack of an increase in the “floor” of the EUR/CHF pair by the Swiss National Bank on Thursday. For reasons unknown, the market was flush with rumors of this increase in the pressure against the Franc by the SNB, and when it didn’t come, the Franc fell against most currencies. However, the downtrend has been broken, and the 0.93 level should play the role of support. I am looking to go long again on signs of support at that level. The USD is still the ultimate safe haven, and there is plenty to hide from at the moment.

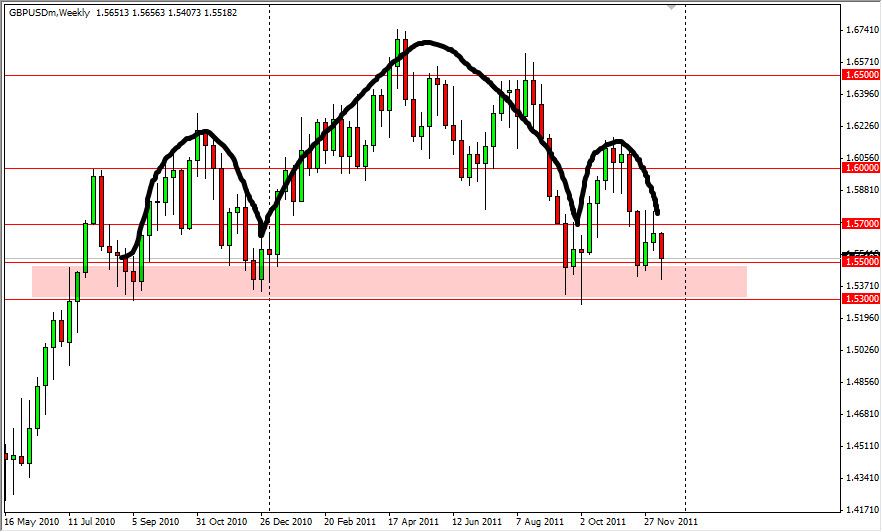

GBP/USD

Cable has fallen down to the 1.55 level recently, only to find support. The level is the start of support that runs all the way down to the 1.53 level. The support level is an absolute must for the bulls to keep, as a break below that mark shows a breaking down of a massive head and shoulders that has this pair going down to roughly 1.41 before the move is over. Bounces at this level aren’t to be trusted until we can get above the 1.57 level as it has also been significant resistance lately.

USD/CAD

The USD/CAD has a long history of grinding before sudden spikes or falls. I believe this is one of those times where it is winding up moving. The recent action has seen higher lows, suggesting to me that the next move is up. However, this won’t be easily won and is more than likely going to be determined in the oil market, not the currency ones. The breaking below the $90 support level in the Light Sweet Crude market or the $95 level in the Brent markets has this pair skyrocketing to 1.07 and beyond. I am not interested in selling this pair until the 0.99 level gives way to the downside currently.