By: Christopher Lewis

AUD/JPY can be a wild pair to trade. Swings over a couple hundred pips in a 24 hour session aren’t exactly unheard of, and during the financial meltdown a couple of years ago, we saw some days that moved over 5 handles!

However, this hasn’t been the case lately. The pair has struggled to break out or down for anything of consequence as the pair has been flattening out over the last several months. The pair can often be a great barometer of risk appetite around the world as the Aussie tends to gain during economic expansion, and money flows out of Japan in search for yield in the same kind of conditions. Of course, it works both ways, and the pair will fall when times are getting rough.

It is in this backdrop that I find this pair so interesting at the moment. The economy around the world seems to be volatile at best, and in normal times, this pair would probably be falling as the uncertainty would push risk assets down. Instead, we have seen this pair completely fall flat since the late days of October.

A Possible Move Coming?

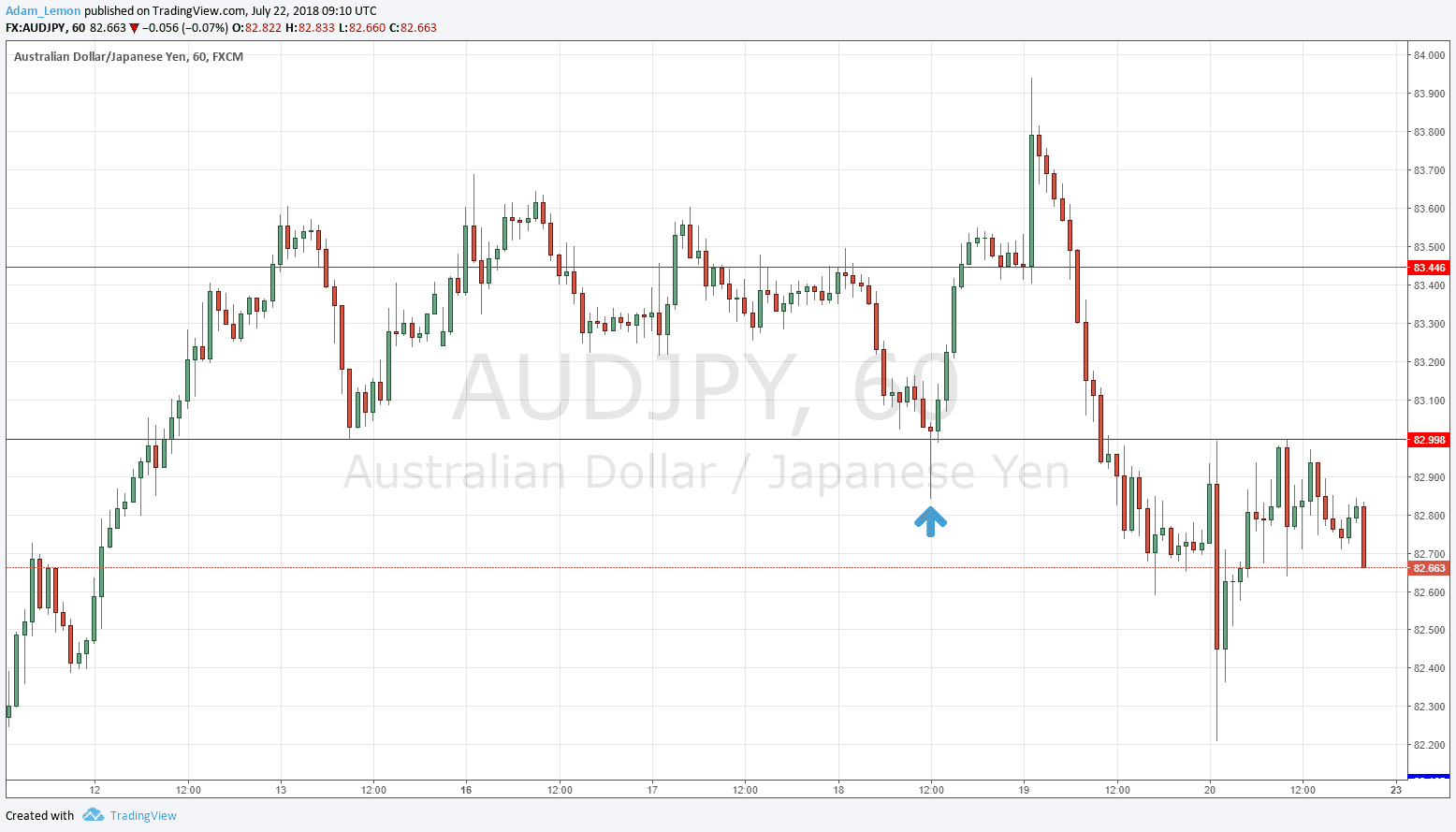

The charts have been tightening up, but I am starting to see several things at one time that lead me to believe that a move is probably coming in the near future. For starters, the pattern that is forming is a triangle, and we are getting to the “sweet spot” where the triangle should break. Of course, it isn’t an ascending or descending one – so the direction still won’t be clear until we actually break out of the pattern.

The 20 and 50 day EMAs both are flat, punctuating on just how dead the pair has been lately. This is completely unnatural in this market, and I believe this will change as well. Of course, the real move is based upon the triangle, and not the averages, but they do show just how flat things are.

Of interest as well is the 50% Fibonacci retracement level that is just above the current level. This is an area that we could see serious resistance, and as a result – this move will probably be explosive once it happens. (The idea being either that a lot of sellers finally take control or the resistance area collapse as the pair skyrockets.) Either way, this pair should give us a good trade in the very near future. A break of the triangle on a daily close has me involved in this pair finally.