By: Colin Jessup

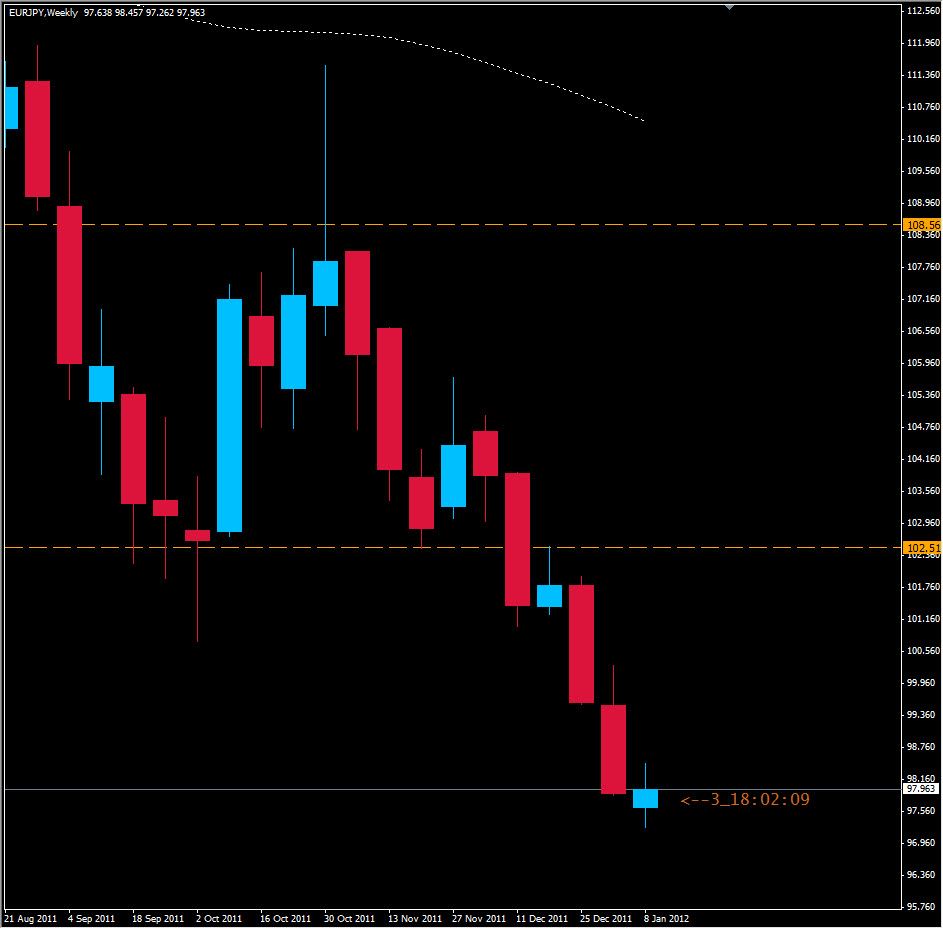

The EUR/JPY appears to be consolidating after its (mostly) bearish run downwards the last 2 weeks. Price moved little in today's trading, after having something of a bullish day yesterday. While price did close higher than it opened today it was only by 13 pips or so stopping its upwards push at the 23.6% retracement zone from the last bearish run.

Now we see prices falling again with little more than 3 hours to the London Open. This could mean that the consolidation period is over and prices will resume the bearish sentiment in the London & New York sessions.

Support will be found at around 97.80 and 97.25 in the short term, with the ultimate goal for the bears being the weekly support zone at 95.75. To the upside the bulls will have to push through 98.50 and 99.25 on the way back to parity. The more likely scenario is that we will continue to see price fall with traders testing the support zone at 95.75 before attempting the low set in May 2000 at 89.97 sometime in the foreseeable future.