By: Christopher Lewis

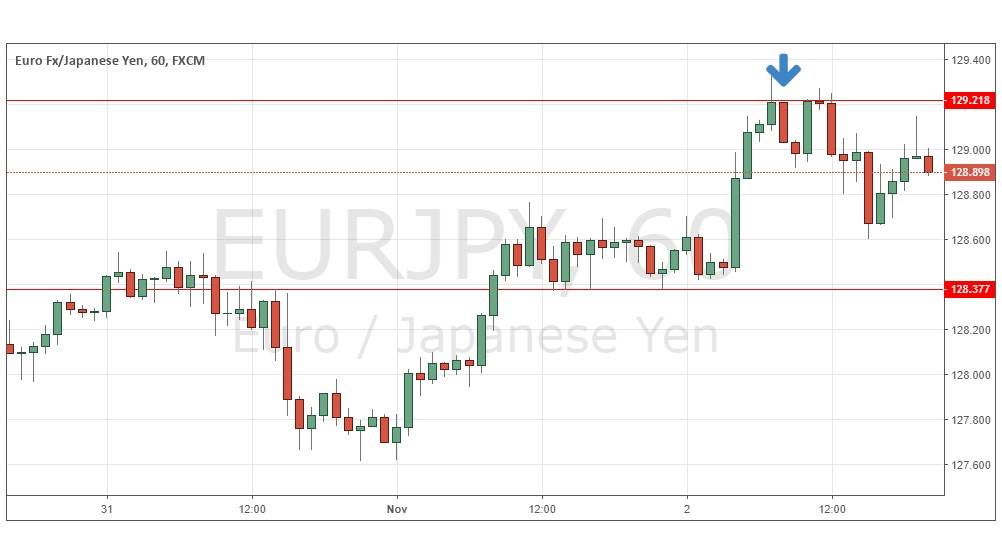

EUR/JPY continued to sell off on Monday as traders run from the Euro overall. Trading volume was almost non-existent, and as a result the moves in most pairs were muted. The breaking below the 100 mark is actually parity in this pair as the Yen is denominated in sequences of 100, and this shows just how weak the Euro actually is at this point in time.

The breakdown on Friday marks a trend in the Euro recently – setting new lows against many currencies. EUR/AUD, EUR/CAD, and EUR/NZD are all starting to look the same. The EUR/CHF pair is only being held up by the Swiss National Bank and its insistence on a “floor” in the pair at 1.20. Everywhere you look, there is Euro weakness and this is something you should be paying attention to.

While the rest of the world has been paying attention to the EUR/USD, this pair has quietly ground lower and has made a fresh 10 year low in the process. The breaking of the hammer from Thursday is significant as that candle was at the perfect spot (100) to see a nice bounce for the bulls. However, we didn’t even attempt to rise from that little bounce – not a good sign at all going forward.

Japan is Intervening

There will be concerns of Bank of Japan intervention going forward by sellers of this pair. While it is certainly possible, it should be noted that the Bank of Japan is more concerned with the USD/JPY rate, and as long as that pair doesn’t melt down, it is unlikely to get involved. Also, the Japanese Finance Minister was quoted recently as saying the USD/JPY is starting to reflect reality involving the Japanese economy. (Another sign intervention may not be coming.) The Japanese are normally pretty good about telegraphing interventions in the markets, and lately haven’t given much in the way of concern for headlines.

Going forward, a break of the doji formed on Monday to the downside would be a nice sell signal. Also of interest would be a retest of the 100 level and a failure to get back above it – a classic “what was once support becomes resistance” scenario. Buying this pair isn’t even a thought at this point.