By: Christopher Lewis

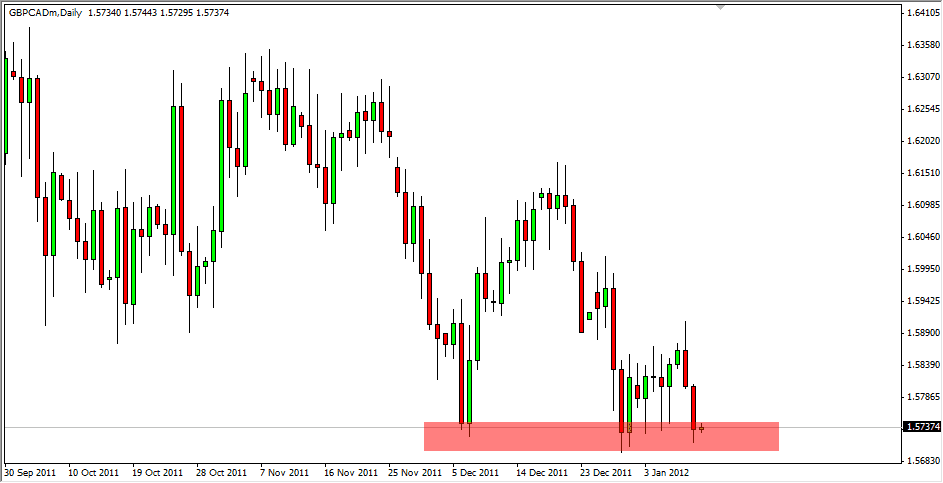

GBP/CAD fell during the session on Tuesday again as downward pressure continues to push this market around. The pair isn’t the most liquid out there, but the fact that the 1.57 level has offered so much support shows just how important the area the market finds itself in is. The level looks to be a stand by the bulls, and if it gives way we could see a significant fall in this pair.

The pair is certainly showing the fundamentals of both economies as the United Kingdom has the misfortune of exporting 30 % of its exports to the European Union. The EU is going into recession, and as a result will be buying less British goods. This should continue to plague the UK economy going forward and as a result the pound in general is on its back foot recently.

By contrast, the Canadian economy is helped by two major factors at the moment. For starters, the Canadians send a large majority of their exports to the United States, an area that is seeing economic expansion at the moment. This should continue to send funds into Canada to buy those goods. Just as important if not more so, the Canadians export oil as well. The oil markets are presently very robust and are putting a bid under the Loonie.

Mounting Pressure

The 1.57 level is a bit of a brick wall at the moment, but the highs are getting lower which of course signals building pressure. The next 200 pips (1.55) could come fairly quick if we can break below this level. Because of this, I am very interested in this pair currently. Adding to this is the fact that the GBP/USD pair looks so weak as well. This could be more of an anti-Europe and pro-North American message by the markets.

The closing of this pair on a daily chart below the 1.57 level has me selling this pair. I suspect that we will see that 200 pip drop quickly as this pair tends to consolidate in tight ranges, and then will suddenly move to the next area. I believe this pair should continue this move going forward.