By: Christopher Lewis

NZD/JPY is a great pair to trade is you have a good handle on the global trading attitude. When times are good, the Kiwi is loved, as there are many investments in New Zealand that offer more of a return than in larger developed countries. For example, many Japanese and Chinese investors will pile into New Zealand bonds which pay much more in yield than safer US treasuries and JGB. (Japanese Government Bonds)

The pair isn’t the most liquid one, so the spreads are a little higher than in other markets like the GBP/USD or EUR/USD. However, this is also an advantage when trading it as it will move much more when the markets get going. This is simply because it takes less to move say 30 pips or whatever. With that in mind, it can get quite wild if you are trying to trade the pair in ultra-short time frames.

The pair has been rising lately, and this is not only because of the “risk on” attitude – the stock markets have done fairly well, but the commodities are doing well too. With this combination, the Kiwi suddenly becomes attractive to traders not only looking to get in on the commodity play, but also looking for higher yields as the Kiwi is the highest yielding major currency out there. (Yen is one of the lowest.)

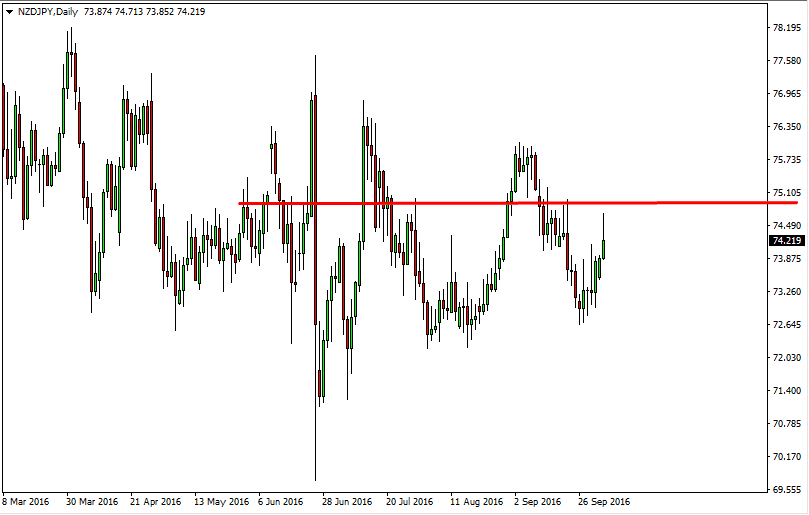

Approaching a crossroads.

The pair has obviously turned around from the long-term fall that it had been in. On the chart, I have placed a purple trend line that was broken about two weeks ago. This would have been the start of the move, and you can even see that one of the days shortly after the breakout, we had a hammer form right on that trend line to confirm the resistance turning into support.

The yellow box shows the resistance area. I think of this as a “zone” because although I have a line at 62.50, there is an argument on several previous candles that the 62 and 63 levels were causing reactions. (Occam’s razor states that all things being equal, the simplest answer is probably the correct one.)

The moving averages on the chart are the 50 and 100 EMA, and they are starting to slope higher and even are looking close to crossing over, which will bring in the long-term traders as well. The one bearish thing I see on the chart is the Fibonacci study that has the area as the 50% retracement of the larger move down. It is because of this that I am watching this pair. I will be more than happy to go long with a close above the 63.50 level on the daily chart as it shows the area being hurdled. The area could also produce a negative or bearish candle, and I am happy to short if that were to happen. However, the latter trade would more than likely be of the shorter variety, aiming for 61 or so.