By: Christopher Lewis

USD/CAD

The USD/CAD pair has been gradually grinding lower over time this past few months, and this previous week saw a bit of a breakdown. However, the parity level still holds as support for the time being. The 0.99 level below also looks pretty supportive at this point, and with the back and forth action in the oil markets, this pair will more than likely be a difficult one to get a handle on. Quite frankly – I intend on avoiding this pair for the time being.

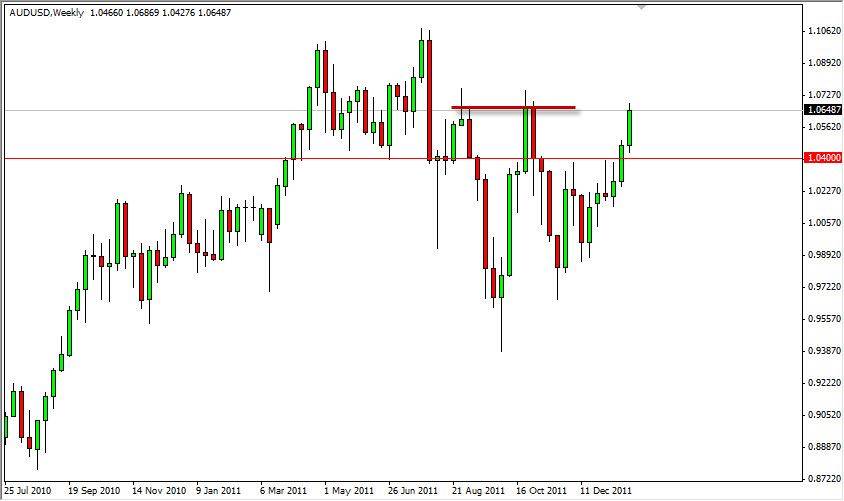

AUD/USD

The AUD/USD pair exploded to the upside over the last two weeks. The Federal Reserve and its continuation of extremely low interest rates did nothing to stop it either. The commodity trade should be in favor now, as the Dollar will lose value against “stuff”. The Aussie gets quite a boost from commodities as Australia exports so many. The 1.07 level is an area that will be resistive, but more than likely it will be a simple pullback in the big scheme of things. Buying on pullbacks is how I am playing this market. 1.04 should now be strong support.

USD/CHF

The USD/CHF pair has had a couple of rough weeks lately, and the closing at the very bottom of the weekly range on Friday will do absolutely nothing to instill confidence at this point. The Swiss National Bank is currently defending 1.20 in the EUR/CHF pair, and if that level gets broken, there is an almost 100% chance of intervention. If they buy that market, this one will move in tandem to the upside. So while the EUR/CHF is so close to that level, I will refrain from buying the Franc at all. Yes, it is obvious that the trade in this pair would be to sell – but with artificial weakness in the Franc a distinct possibility and at any time – I would just as assume pass on this one.

EUR/USD

This is the epicenter of all of the volatility at the moment. What was once considered to be the most fluid and steady major pair to trade has been a real chore over the last few months. The back and forth will continue unfortunately, as there are simply far too many variables out there with the debt crisis. The 1.3250 level is a bit of a support and resistance area, and the recent move has been a bit overdone quite frankly. However I also think 1.30 could be support as well. The market will continue to chop around, and I also see 1.3250 as a signal in and of itself….if we can close above it on a decent daily candle, we will go to 1.35 before it is all said and done. However, weakness at this level could also been seen – the 100 day EMA is there as well as the 38.2% Fibonacci retracement level. I am waiting to see the daily reaction to the level before pressing in either direction. No matter what – tight stops are in order.

GBP/USD

Cable has had a couple of really strong weeks. However, the pair is starting to run into strong resistance in the 1.57 to 1.58 area. The pair is due for a pullback, even if the trend were on the upside. Truth is however, it hasn’t been lately and this should suggest that the pair is about to fall again. Keep in mind that the UK GDP number was actually negative last week. This hasn’t been priced in yet. I am looking for weakness from which to sell in this area going forward. A daily close above 1.58 completely destroys this thesis.