By: Christopher Lewis

EUR/GBP has been in a bear market lately, as the Eurocentric issues continue to drag on. The Euro has suffered against almost all currencies over the last several months, and the Pound has been no different.

The pair has recently seen a bit of a grind higher, and only in the last few days has the pair fallen again. The pair really started to decline once the 0.85 level was broken. The pair does have a history of grinding and not freefalling, and as such I am not expecting fireworks in this pair, just nice steady moves if history is any indication.

The UK is slightly more attractive than the European Union, if only because the UK is actually doing something to address their financial issues in the form of austerity. The Europeans are still dickering around the edges, and as such – people feel much safer investing in the United Kingdom than the mess that is Europe at the moment.

Breaking Trend Lines

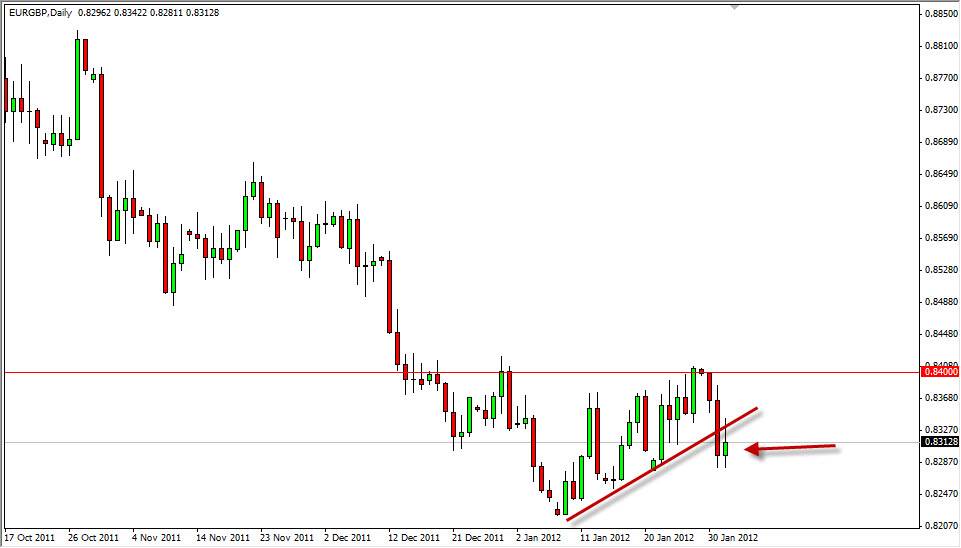

The recent movement in the EUR/GBP pair has seen it retesting the 0.84 level for resistance and the level did quite well. The failure to get above the area shows just how bearish the pair really is. It is a fight between two ugly currencies, and although neither is one that traders seem to want long-term, the Pound is starting to break out against the Dollar as well, and the fall in this pair should be treated seriously.

The recent grind has also seen an uptrend line, and as we broke down below it on Tuesday, it was a signal that we might fall again. The Wednesday candle saw the pair rising back above the line, only to fall again and form a shooting star. This candle is a sign that the pair wants to fall, and a break below the bottom of the daily range for Wednesday gets me short.

The 0.80 level is a historical norm in this pair, and as this is the case – I am aiming for this level when I short it. The pair doesn’t move fast, but it does move methodically. The steadiness of this pair does dictate that you are patient, but as long as you can be – it is a good set up. Currently, I have no plans to buy.