By: Christopher Lewis

EUR/GBP isn’t a pair that moves quickly. Because of this, a lot of traders don’t typically get involved in it. However, one of the great things about this pair is the ability for it to trend for long periods of time, and if the trader is willing to be patient – it is fairly steady in its movements.

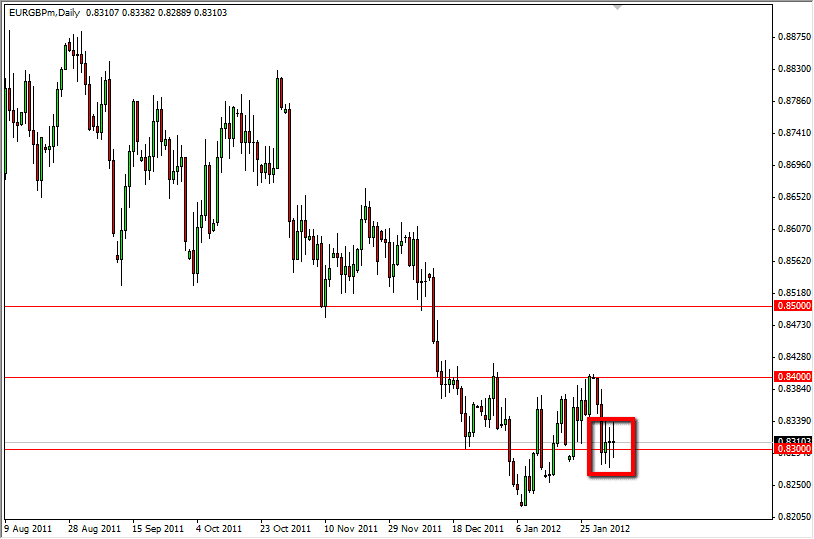

The pair is also a very technical one, and as you can see on the chart attached, there are reactions that are plain to see every one hundred pips. This can help traders as it suggests that the only question the pair is asking goes something like this: “Now that we are above this handle, will it hold, and are we going to reach the next one?” The pair is very predictable in that sense, but as with anything else – there isn’t a 100% positive way to know if it will make it to the next level, but it does have a good solid history to draw from.

Two ugly currencies

The trick with this pair is the fact that the two economies are so interconnected is why the pair doesn’t move quickly under most circumstances. The UK sends over 40% of its exports to the European Union, and the fact that the European Union is going into recession will certainly have a negative effect on the GDP of the United Kingdom. The Europeans have sold much of their debt to the UK, and as those banks struggle, it takes an important player out of the debt markets in the EU. As you can see – a lot is interconnected.

The 0.83 level is currently acting as support, and as long as the level holds, we will find ourselves a bit hard pressed to sell. The trend is down, and certainly the Euro isn’t something I want to own. So with this in mind, I am looking for a sell position on a daily close below the level, or if we do get a pop in the pair, another failure to break above the 0.84 level. Either way, buying isn’t a thought.