By: Christopher Lewis

The EUR/USD pair has been a real challenge for many traders lately, and the Tuesday session did very little to alleviate the back and forth nature that the pair has been trading in over the last several weeks. It seems that every time we get sentiment moving in one direction – there is a headline or errant comment that sends the pair in the opposite direction.

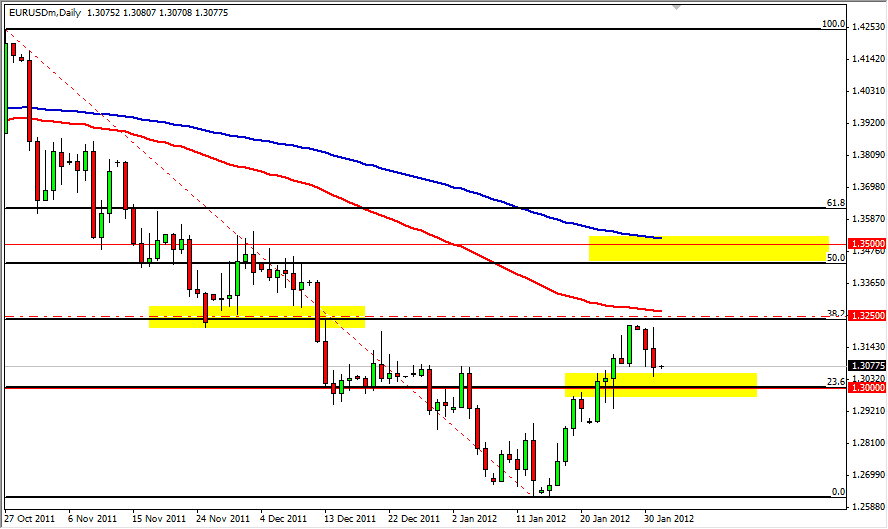

The fall in price on Tuesday was accomplished only after bullish action in the early hours. The 1.32 level had been resistance previously, and this is where the bulls tried to run the pair back to during the previous 24 hours. However, they failed to break through, and the whippy price action continued as traders still cannot decide on a direction.

38.2, 50, and big figures

The pair pulling back from the 1.32 level lined up quite nicely with the 38.2% Fibonacci level from the previous fall. In yesterday’s piece, I mentioned this area as a potential spot for a pullback, and as the market failed to get under the support level from 1.29 to 1.31 below, it looks as if the prediction has come true. However, the real challenge is at 1.35 in my opinion.

The 1.35 level is also the 50% retracement, and this is an area that will almost always produce some kind of reaction. With that in mind and the fact that the 1.35 level is such a large and obvious level – it looks as if it will be where we see significant resistance.

The biggest problem in this pair is that the 1.32 and 1.31 levels are both significant to traders out there. This is forcing the pair to squeeze in this vicinity, and is going to continue the difficult trading conditions for the short term. The pair simply is being pressured from all directions as the world cannot get its collective head around all of the issue in Europe.

Granted, I still maintain that the pair will fall over time. The Euro is simply too high for the periphery to come out of this mess intact, and if we are to see stability in the long run – this pair will fall overall. However, this is a longer term view of mine. In the mean time, it looks like the pair could continue to rise as the 1.31(ish) area has managed to be both resistive and now supportive – a basic tenant of technical analysis. I think we see higher prices until about 1.35, where we could see the 200 day moving average (EMA) come into play with the 50% Fibonacci level. Add in that a whole mess of European financial issues and this pair should fall from that area