By: Christopher Lewis

EUR/USD has been consolidating over the last several sessions, and with the Non-Farm Payroll report coming out tomorrow, there isn’t much in the way of catalysts to push the pair around in my estimation. Of course, there is also the fact that we are talking about the European Union, so there is always the possibility of headlines coming out to send the pair either up or down. No matter what, it appears that this pair is tightening up, which is something that you will see before a serious move quite often.

The Euro is still the epicenter of all things bad, but the Federal Reserve did its best to kill the Dollar a few days ago as it mentioned that the ultra-low interest rates will continue until the end of 2014. This was 18 months longer than previously expected, and this of course caused an acceleration of the selling of Greenbacks.

Between a Rock and a Hard Place

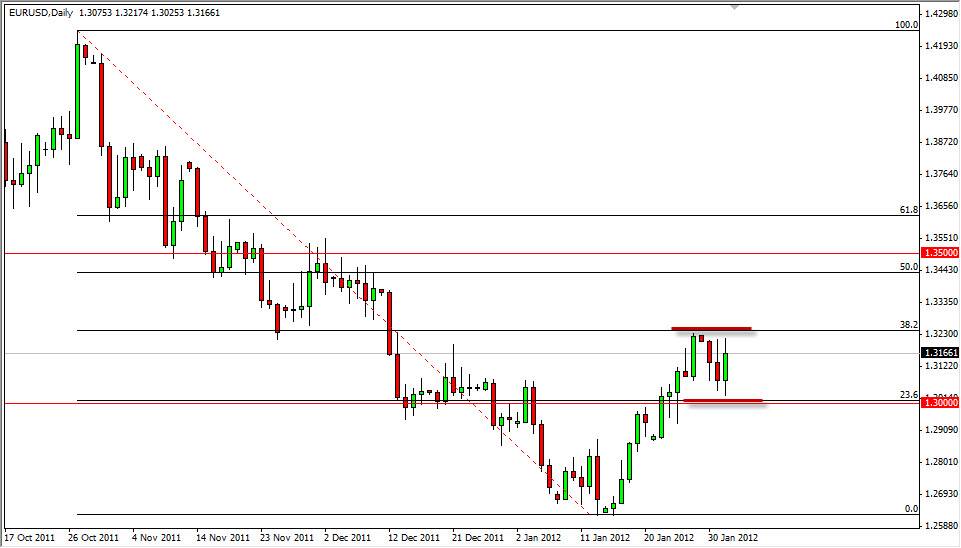

Much like the old saying, this pair simply is “stuck” between two barriers at this moment. Further making it difficult to trade, the range is only 200 pips or so – allowing very little chance of a trade lasting more than a couple of hours at best.

The 38.2% Fibonacci retracement level is sitting at the top of the range – roughly 1.32, and the 23.6% retracement is at the bottom of the range – roughly the 1.30 level. The area looks very tough, and this continues to push this market back and forth. However, there is a simple way to use this to your advantage: Simply buy the breakout above the 1.32 level, or sell the breakdown below 1.30 or so. The trend is down, and there are a lot of Euro-negative headwinds out there. Because of this, I would much rather sell thing pair than buy it, but it isn’t me who pushes price around. I have to simply go with whatever the larger forces dictate. At this point in time, I have those two levels to tell me what they think. However, I am willing to bet that the real move isn’t until post- NFP numbers on Friday.