By: Christopher Lewis

The EUR/USD pair continued to chop about on Friday as the Non-Farm Payroll numbers came out better than expected. The jobs report normally has a positive reaction in this pair when it is good, and the fact that it couldn’t maintain the gains in the early part of the session suggests that perhaps the issues weighing on the Euro continue to be forefront in the minds of currency traders.

The debt issues in the European Union will only get worse in the next few months, as March sees an astronomical amount of debt coming into the markets. It has been suggested that the month of March could be what sets the tone for the Euro going forward. The bond markets often dictate the flow of capital, and as such – you must be aware of any failed auctions out of the EU.

The Portuguese are starting to make rumblings about a possible debt restructure as well, and if this does in fact happen, I cannot see how Spain, Ireland, and Italy won’t ask for the same treatment. The truth is European debt markets are probably going to be weak for the foreseeable future as investors get burnt in several different places at once.

1.32 And 1.30

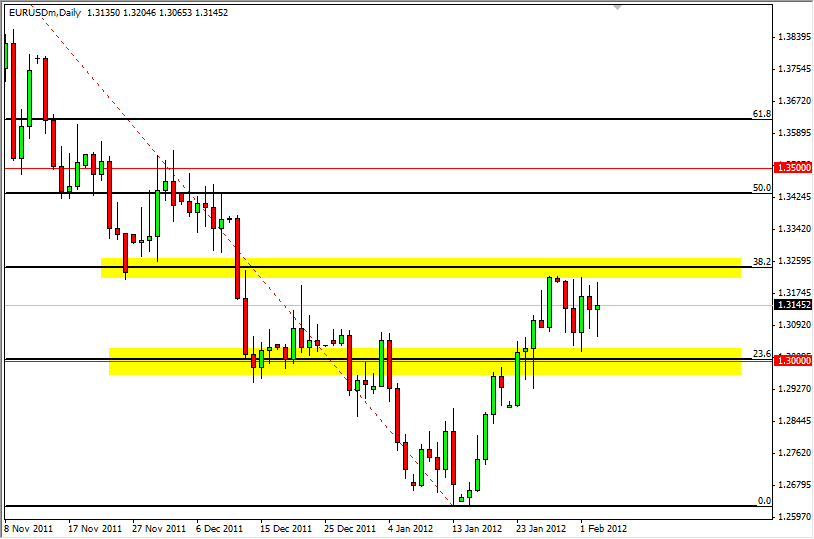

The 1.32 level continues to keep downward pressure on the pair, and the area is also the 38.2% Fibonacci retracement level from the plunge down that started last year. The area has been obvious resistance, and in order for the bulls to continue to push the pair higher, this level will have to be overcome and closed above on the daily chart. The pair does look like in the meantime, we may see more choppiness and sideways movement, which with all that is going on isn’t a real stretch of the imagination.

The 1.30 level continues to be supportive, and should be thought of as a large “zone” going all the way down to the 1.29 level, and actually starting closer to the 1.31 level. This thick zone does suggest that the breakout is probably going to be to the upside and above 1.32. However, 1.35 is the top of the large consolidation, so gains would be somewhat limited. A break below 1.29 has the market gunning for the 1.25 level.