By: Colin Jessup

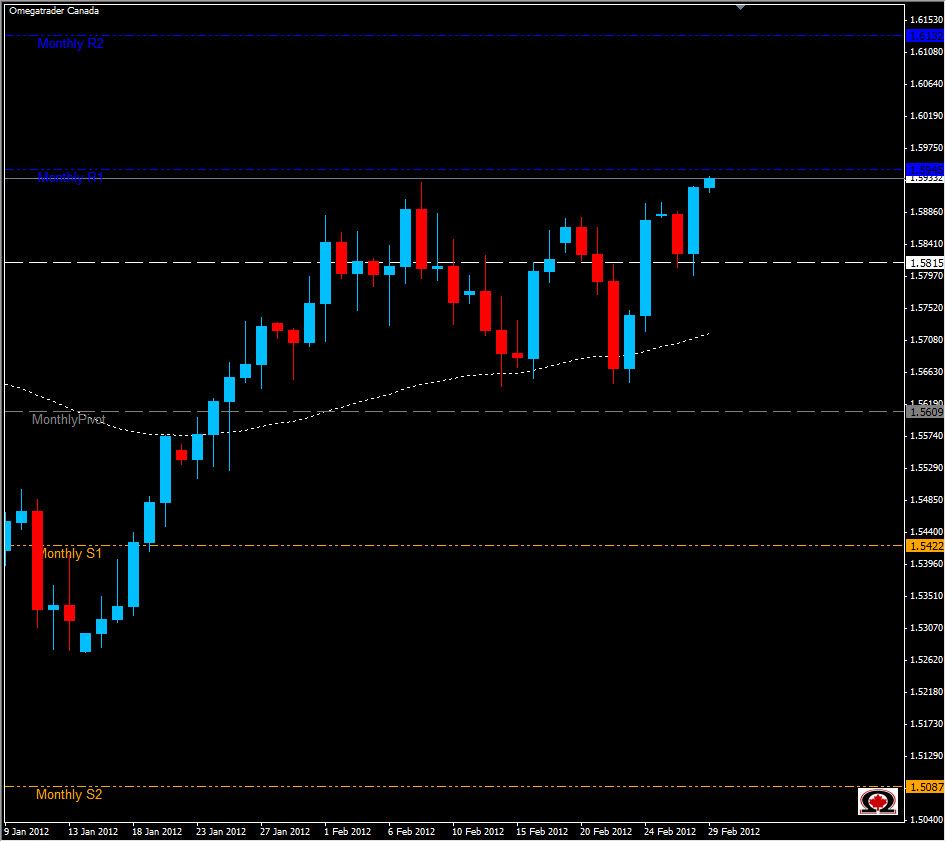

The GBP/USD has broken above 1.5935, a level not seen since November 15, 2011 and the high from February 08, 2012 which was 1.5929. This apparently comes on the heels of the surprising CBI realized sales numbers which rose to -2 points. The pair seems unfazed by the troubles of the EU and Greece, and along with the Euro chart continues to be bullish with cousins such as the USD/CHF and USD/CAD charts continuing their bearish momentum. The Bulls may be hindered by the Weekly R1 which sits above at 1.5959, but now has support at 1.5900. If the R1 is broken, 1.6100 is not out of the question in the days to come as there is little in the way of resistance until 1.6104. Bearish traders will encounter support not at the previously mentioned 1.5900 and major resistance at 1.5815. While the pair has not moved very far since shortly after the New York Session closed, it has remained slightly bullish and is probably that we will see this pair climb higher, although a pullback to 1.5870 is not unrealistic first.