By: Christopher Lewis

USD/CHF has suffered a significant pullback since reaching the 0.96 handle a little over a week ago. This pullback has been predicated by the EUR/USD strength that we saw simultaneously. The pair will typically more inversely from that pair, but the recent situation in Switzerland does have it acting a little differently than usual.

The Swiss find themselves in a bit of a pickle currently. The Swiss send 80% of their exports to the European Union, and as that area enters recession, the largest customer of Swiss firms that export in volume is simply going to be buying less. This will create a drag on the Swiss economy, and will be very difficult to avoid in the next year or more. With this in mind, the Swiss National Bank had been trying to avoid a run to the Franc.

The EUR/CHF pair has a “minimum acceptable rate” in which is can be traded according to the Swiss National Bank. With this in mind, it follows that a sub-1.20 print on the EUR/CHF pair invites intervention against the value of the Franc. When this happens, all XXX/CHF pairs will rise in concert as Francs are sold by the central bank.

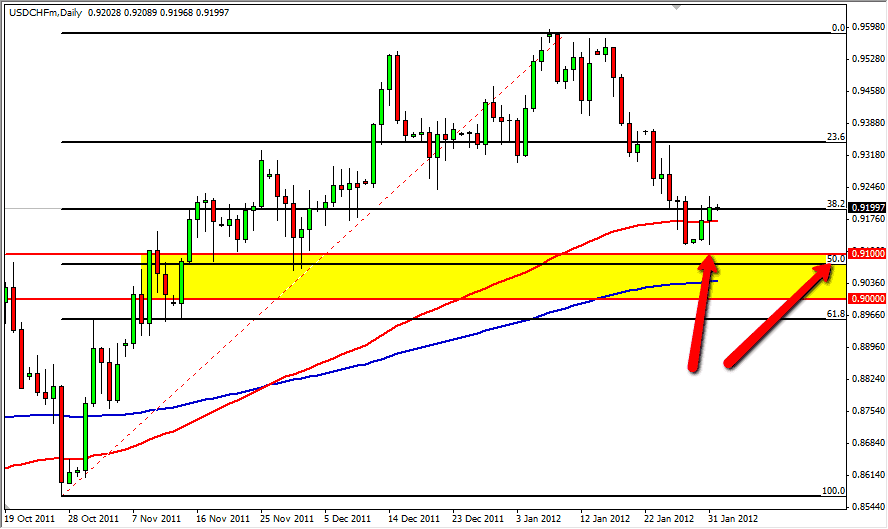

50% retrace, 0.91, and moving averages

Looking at the EUR/CHF pair, traders came dangerously close to finding out just how serious the SNB is about the 1.20 level in EUR/CHF on Tuesday, coming within 40 pips of that level. Because of this, the SNB is certainly watching. With this in mind, the threat of intervention is greater than ever.

The USD/CHF is currently at the 50% retrace area from the most recent thrust higher. The 0.91 level is supportive as it was once resistance, and the recent pullback is a bit severe. The Dollar continues to be sold off in general as the Federal Reserve keeps rates low for an extended period of time, but the Franc is likely to be intervened against – a major difference.

The moving averages line up with the area that we are in currently. I plotted a 100 EMA in red, and a 200 EMA in blue and as you can see – they are supportive at this point. The Tuesday candle was also a hammer, a supportive sign in and of itself. Because of this, I am buying this pair on a break of the Tuesday highs. I personally believe we are going to aim for 0.95 – 0.96 before it is all said and done. I simply cannot sell this pair at the moment as the threat of intervention is so high currently.