By: Christopher Lewis

USD/JPY continued to fall on Tuesday as traders bought the Yen overall in the currency markets. The pair has been decidedly bearish since the financial crisis a couple of years ago, and every pop in price that we have seen has simply invited more selling.

However, there have also been several interventions by the Bank of Japan in the last year or so, and this always has traders nervous. In this kind of environment, the possibility of the pair rising 200 pips in a flash is always out there, and as such I prefer to avoid selling it as a result – unless we are at lofty levels. Currently, we aren’t anywhere near lofty levels.

Because of the obvious problem with selling, this pair has been one that I trade with less and less frequency these days. Most trades are of the short term variety, and holding onto a position for more than a day or two has been almost impossible as the range has also been tightening over the last several months.

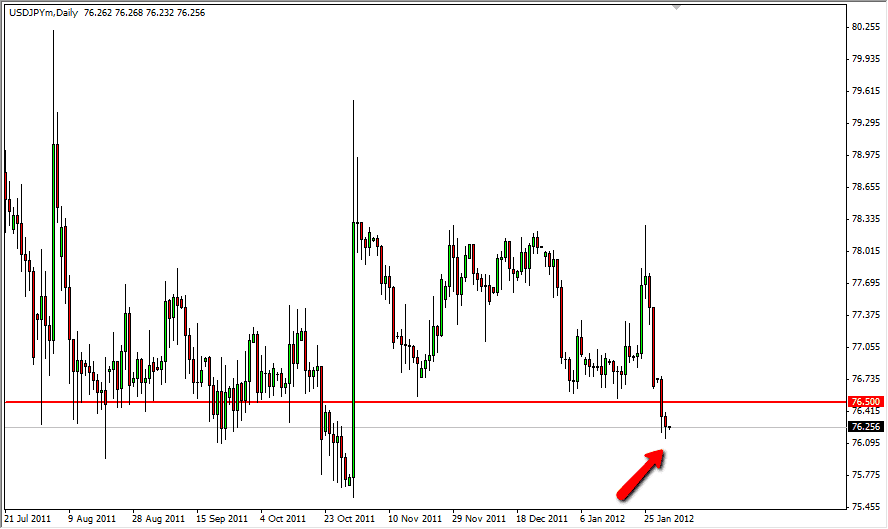

76.50 gives way

Recently, we have seen a lot of support at the 76.50 level. Yesterday, this gave way decisively as the sellers stepped in. For the first time since this most recent selloff began, we started to hear comments from officials at the Bank of Japan. The Bank of Japan seems to have a pattern of making several comments before acting. The central bank also is known to do semi-clandestine operations at times. It was perhaps them that were behind the massive support at 76.50. However, there is also the possibility of large exporters buying at that point as well. None the less, it was a significant level.

The breakdown was significant, but there is simply no way to sell now. The daily candle for Tuesday is a hammer, and this reversal sign is one that often precedes a countertrend move. At this point in time, I am willing to go long in order to position myself for intervention, but I also want to hear more comments from officials at this point. Because of this, I am waiting for one of two things: Either a break of the top of Tuesday’s hammer, or another round of comments by BoJ officials. I will enter with a smaller than usual position though, as it could be a long wait as central banks tend to work on their own time frames.