By: Christopher Lewis

EUR/USD

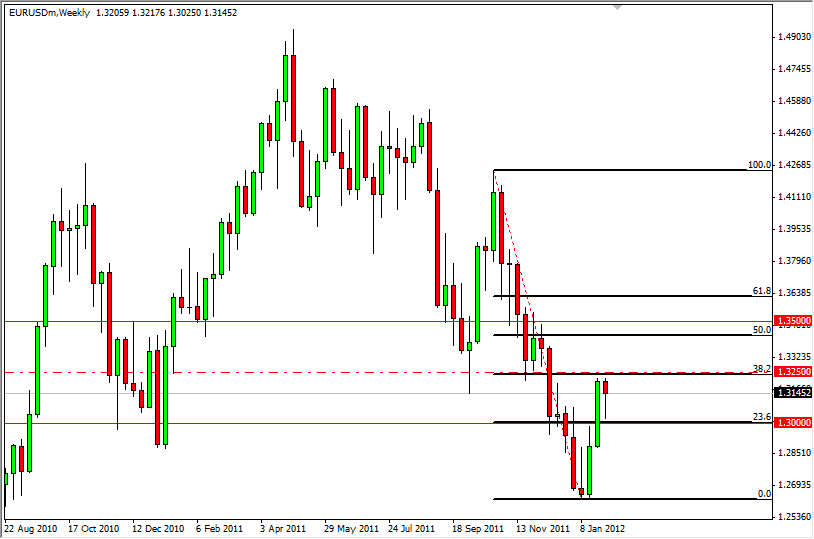

EUR/USD continued to chop around for the previous week, and looking forward it may just be the way this pair will be for quite some time. The weekly candle is a hammer of course, and this is bullish as it shows that the pair is still trying to build upside pressure. However, the 1.32 level continues to fight the bulls. This will guarantee that the pair will remain choppy as there is plenty of reasoning for both sides of the argument.

Looking at the future, it appears that the 1.35 level is that target for the bulls, and it does line up between the 50 and 61.8 percent Fibonacci retracement levels on the most recent downtrend. The EU has plenty of issues still, and perhaps this should bring in more sellers at the 1.35 level. With the set up currently, a daily close above 1.32 sends the pair to retest 1.35. The entirety of the range we are in presently measures from 1.30 to 1.35, and will remain so for the near term.

USD/JPY

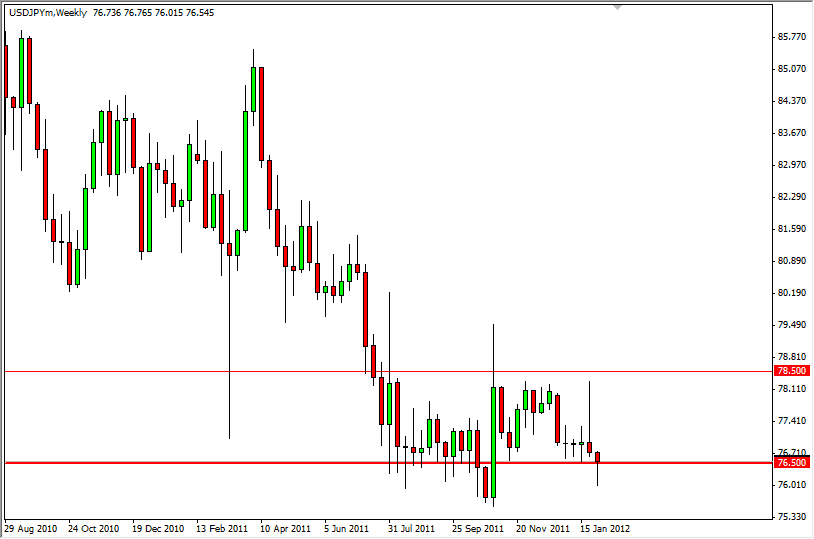

The USD/JPY pair had spent most of the week falling, and even got low enough that the market was anticipating Japanese intervention. However, the Non-Farm Payroll numbers were strong enough to push the pair higher, and managed to close above the 76.50 support level before the week closed. The level has been supportive over the last several months, and it looks like with a break above the top of the weekly hammer, we will see this market rise back into the former consolidation range. The top of this range is roughly 78.25, and this will be the target for the bulls. All things being equal – this pair should find itself bouncing around in this range.

USD/CHF

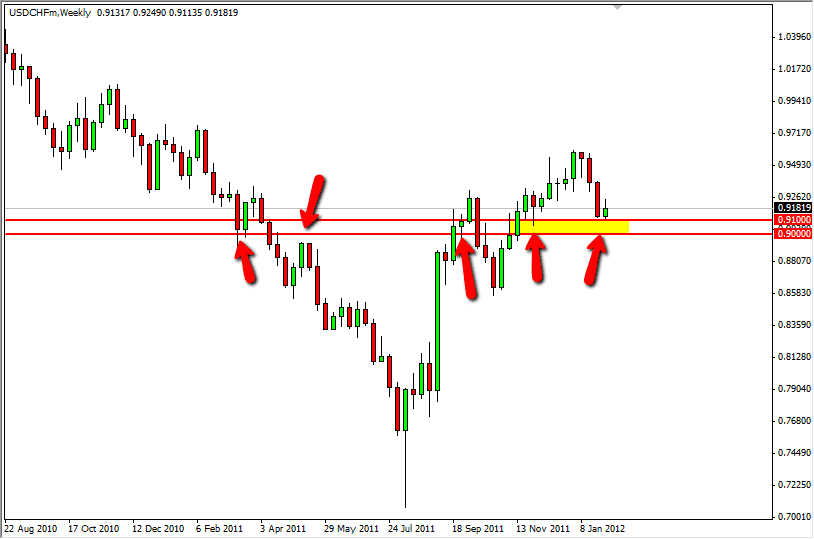

The USD/CHF has been weak lately, but the 0.90 level is coming into view. This area extends up to the 0.91 level, and I see this as a 100 pip support zone, and this area should continue to fight. The candlesticks do suggest further weakness, but the Swiss National Bank has been jawboning the value of the Franc down, and there is an obvious intervention level in the EUR/CHF that has been looked at by the market recently. The Franc will more than likely be tepid in its strength because of this. Although we have the candlesticks to suggest weakness in this pair, the SNB is something to think about – meaning this pair might not be tradable unless we get some kind of supportive candle between here and the 0.90 handle.

AUD/USD

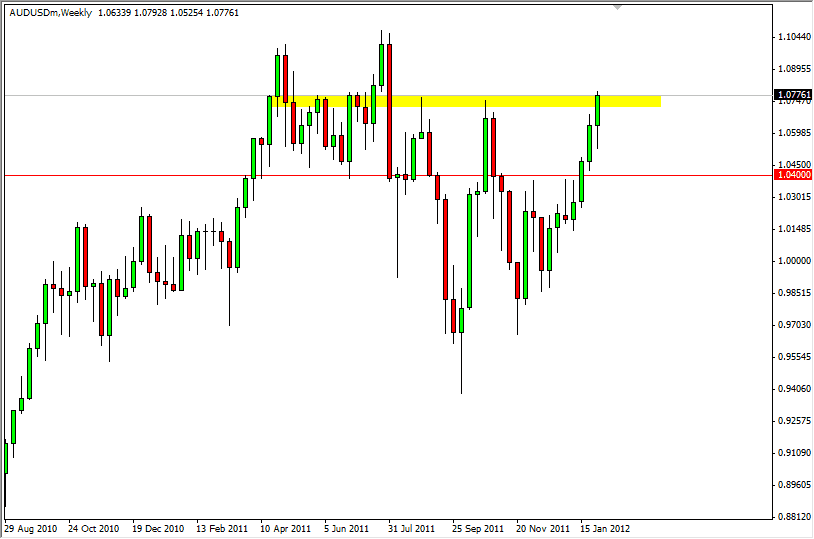

AUD/USD looks a bit toppy at present levels. The 1.08 level certainly is one that has been resistive in the past, and the recent move has been far too parabolic to consider the long side at this point to be one I am comfortable with. Because of this, I can only assume there is a pullback coming. However, I would only buy this pair as the Aussie is so strong. With this in mind, a pullback to the 1.04 level would be ideal, but any of the handles below will be capable of producing the supportive candle I will be looking for. A break above 1.08 sends this pair much higher, and although I would prefer the pullback – I would be forced to go long at that point.

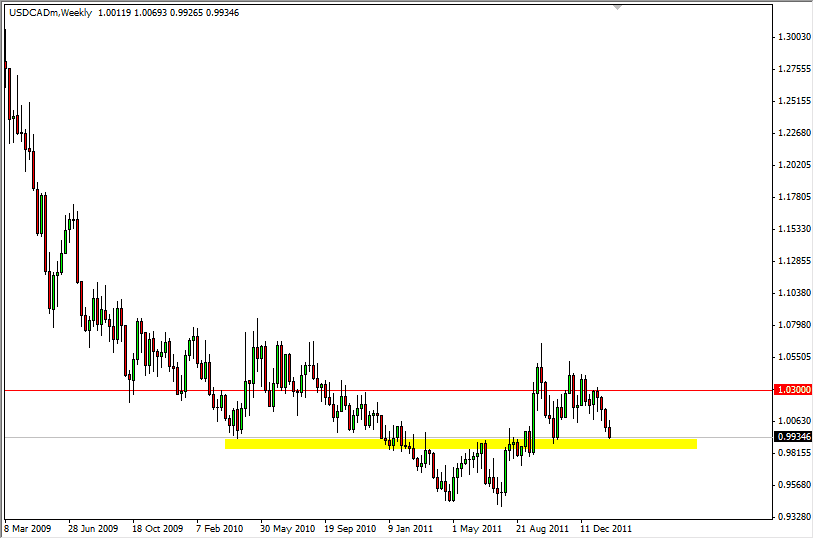

USD/CAD

The USD/CAD pair has fallen again, but the 0.99 level looks very supportive. The oil markets will continue to influence this pair, and so will the US economy’s strength. The pair has been fairly choppy, which is normal for the pair. The 0.99 should be important enough to cause a reaction, but if the pair can get below 0.9750 – there is nothing below it in the immediate future to keep it up at that point. Because of the various support and resistance levels – parity, 0.99, 0.98, and 0.9750, I will probably stay out of this market for the time being.