By: Christopher Lewis

EUR/USD

EUR/USD continues to bounce around in the 1.30 to 1.3250 range. The pair has formed a couple of supportive candles on the weekly chart recently though – so it is entirely possible that the breakout will come to the upside. 1.35 provides another challenge to the bulls as well. With the Monday EU meeting on Greek bailouts coming, the pair is probably best left alone until the range is broken out of completely, no matter the direction.

AUD/USD

AUD/USD had another fairly quiet week. This is very odd to be honest, as the markets continue to worry about all things European. The pair typically should move in one direction or another, but the lack of movement will certainly be something to watch. The 1.08 level just above is very resistive, and the shooting star from the previous week still looms large in this pair. The 1.04 level below will hold the pair up though, and any pullbacks will be buying opportunities in my opinion.

USD/CHF

USD/CHF continues to bounce around near the 0.91 level. The pair is being held up by the Swiss National Bank by proxy as the EUR/CHF is being defended at the 1.20 level. As long as that is the case, it is going to be difficult to have a serious breakdown in this pair as the value of the Franc is going to be artificially low. If the EUR/CHF falls too far, there will be intervention, and this will have an effect on this pair as well. Because of this, I can only buy it, but the candlesticks show a real lack of momentum at the moment.

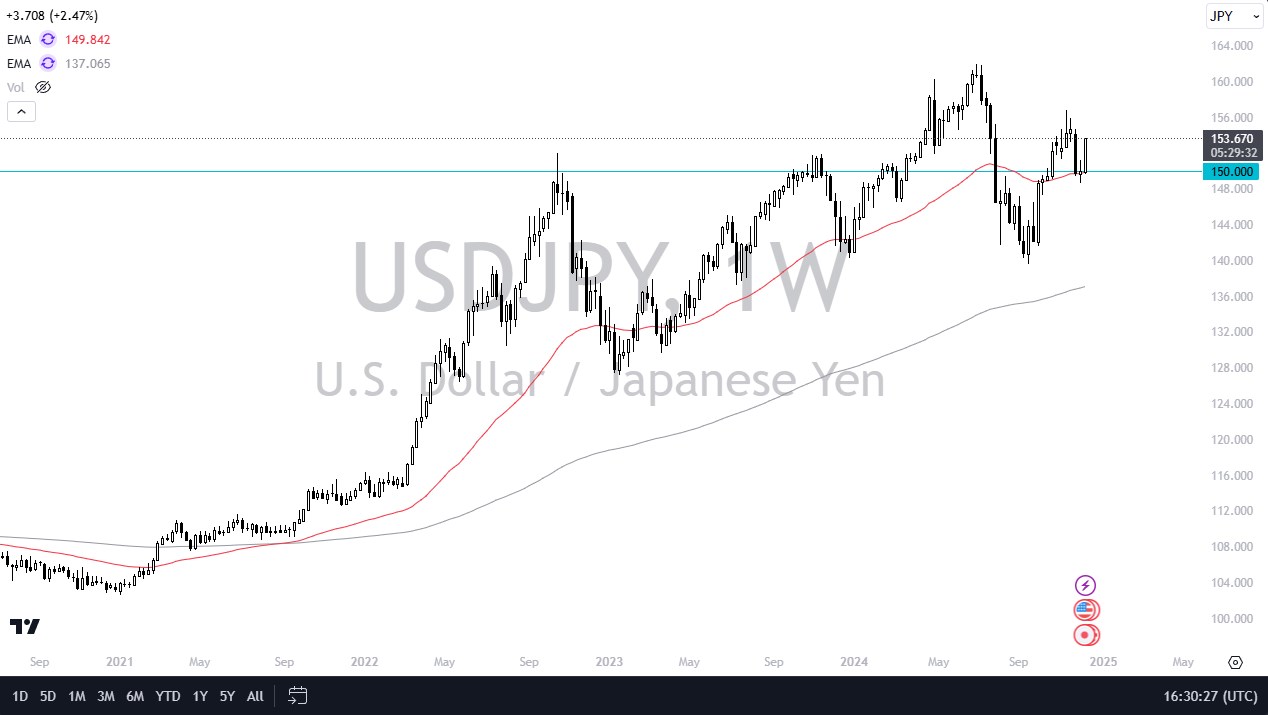

USD/JPY

USD/JPY acted like it was shot out of a cannon this past week. The Bank of Japan has stated it is going to expand its bond buying program, and as a result the Yen go t much weaker. However, the 80 level is just above, and I feel this is where the real fight is going to happen. I think by this time next week, we should know the future direction of this pair. A post-80 level close is bullish and gets me in the long-term buy and hold camp. However, if we see a resistive stand, we could revisit 76.50 in short order.

GBP/USD

The cable pair has broken below the bottom of last week’s shooting star, offering a sell signal. However, the pair got a bounce and formed a hammer. The daily chart shows the Friday candle as a shooting star at the 1.58 level, and I am going to have to go with the trend on this one – I think the most likely move is down. This doesn’t mean it is going to be a straight shot down, but I think overall the Pound is overvalued, and the parabolic nature of the move suggests more of a pullback. The breaking below 1.5650 or so is a very negative sign. I won’t buy until we are above 1.60 or so as it would show real strength at that point.