By: Colin Jessup

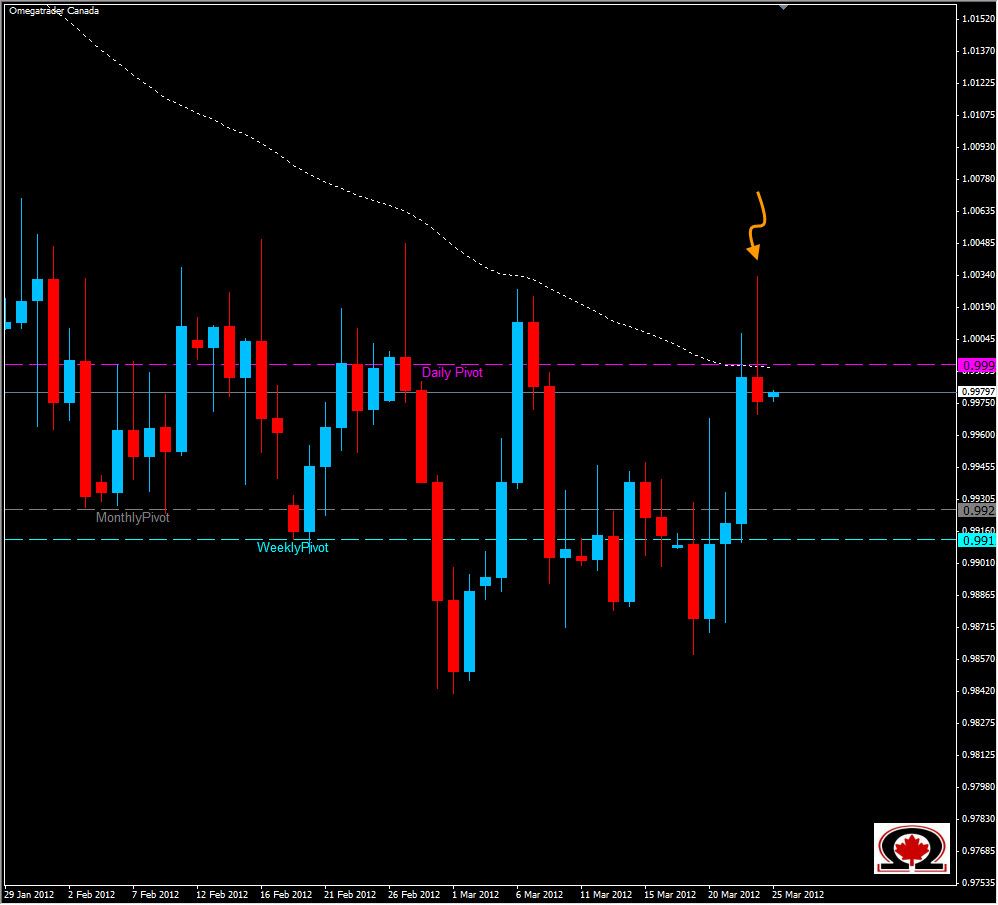

The USD/CAD daily chart printed a perfect 'Pin Bar' or 'Shooting Star' formation after Friday's trading action. This strong reversal pattern printed by closing below both the Daily Pivot level at 0.9990 and the Daily Moving Average of 0.9991 after testing the waters as high as 1.0336. This created a long 'Tail' with a small body, indicating prices were going to reverse once more. The pair has been trading between 1.004 and the Weekly S1 at 0.9870 since the end of January, and considering the Yo-Yo effect of the Greenback this is likely to continue for awhile. Canada's economy is stable, even strong is some areas such as Oil Exports which keeps the Loonie, as it is affectionately known, relatively strong. If the pair continues to fall, look for support from the Weekly Pivot at 0.9995, Daily S2 at 0.9930 and Daily S3 at 0.9890. If price resumes bullish look for Resistance at 1.000, and Friday's high at 1.0033 with the Weekly R1 and Daily R2 above that high around 1.004 and 1.005 respectively. I remain slightly bearish on this pair.