By: Colin Jessup

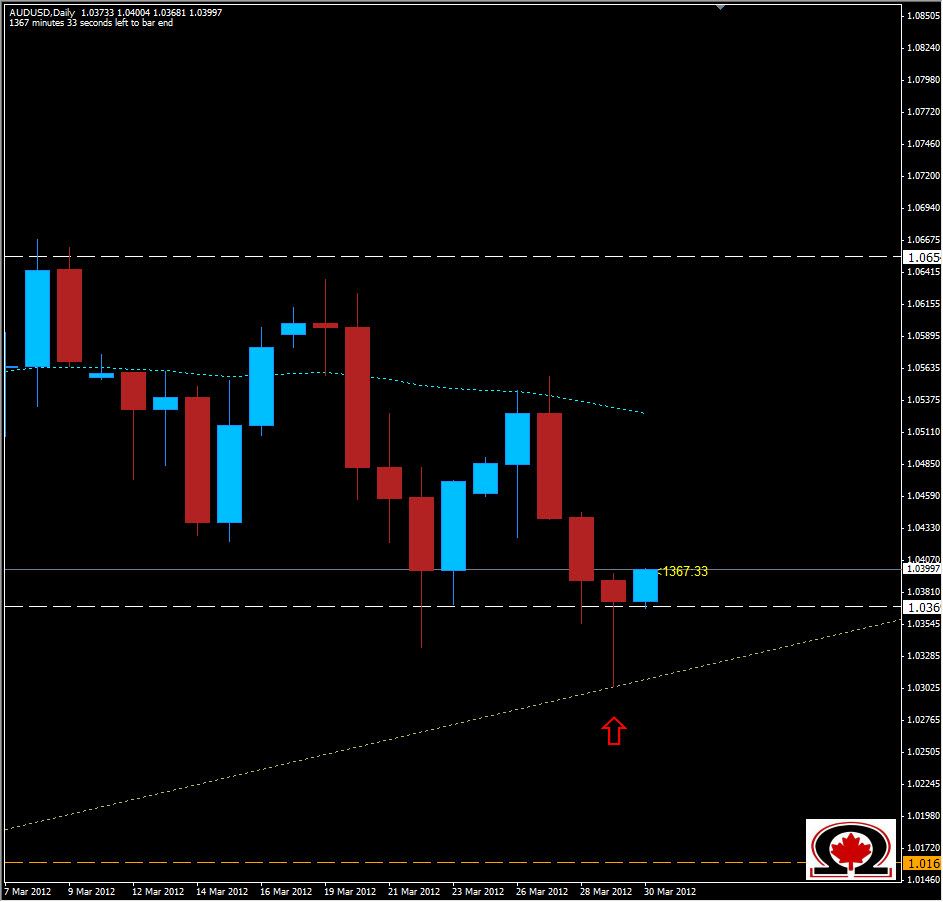

The AUD/USD, which I often call the Pacific Peso, has reached a strong support zone at 1.0360 that has history going back years and has caused both Bullish and Bearish trends to pause and reverse or retrace. The pair traded as low as 1.0303 stopping and reversing just 13 pips above the Monthly S3 at 1.2990 before closing slightly lower than opening at 1.3072. This has printed a Daily Hanging Man or Hammer formation to some with the tail confirming an Ascending Trend Line originating on October 04, 2011 at 0.9386, with the wick fo today's candle being a third touch. With so many forms of resistance lining up together it is highly likely that the pair will bounce and retrace, possibly to the 38.2% level at 1.0513. Along the way, the Bulls will encounter the Daily R1 at 1.0411 and Daily R2 1.0445. The Weekly Pivot lies in between the Daily R2 and the 38.2% retracement level at 1.0485, which could be the toughest level to crack. To the downside, we see little as far as support until we hit the Daily Pivot at 1.0357,and have the Weekly S1 directly below that at 1.0334. While the overall trend is Bearish, I am Bullsih on this pair if we close above 1.0411.