By: Christopher Lewis

The AUD/USD pair is without a doubt one of the favorites for traders to buy when times are good. The pair is a proxy for gold, copper, and even oil to a lesser extent. (It should be said commodities in general.) The Australians export a lot of hard commodities, and as a result the currency can often be tied to other economies much more than its own.

A perfect example is the fact that you can trade the Aussie based upon the Chinese economy. The Aussies sell a lot of metals to the Chinese, and as the Chinese economy goes – it suggests the amount of demand for these commodities will coincide with the expansion or contraction of the Chinese economy.

The recent fall in this pair may be somewhat counterintuitive as the US economy seems so sound, which in turn should drive all the others. However, the Federal Reserve Chairman failed to mention any hints of further easing, and as a result the Dollar on the whole is gaining. This would suggest that perhaps the commodity trade will slow a bit, and of course this move this pair as well. (The commodity markets may slow, but nobody is calling for a bear market.)

Moment of truth?

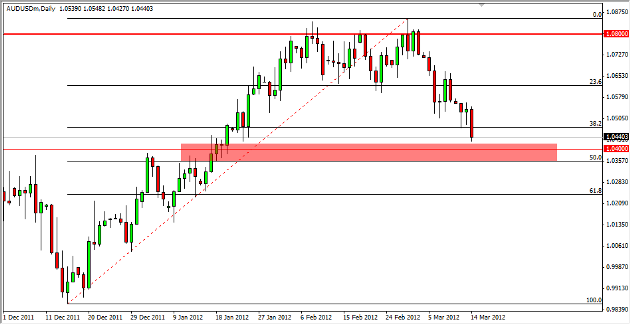

The 1.04 level below was the site of a massive breakout from a daily triangle that started this uptrend. The pair should find some kind of support at this level, and as we are so close – selling isn’t possible at this point. In fact, I am looking to find reasons to buy this pair at the moment, but will be very patient. We are near the point of the breakout, so now we will have to see support at this point.

With this in mind, I think the next day or two are going to be crucial for the future of this pair. I am waiting to see if I get that perfect hammer, a nice bullish engulfing candle, or other such reason to buy near the 1.04 mark. I am only willing to sell if we close on the daily chart well below it, and at that point I think the entire move could be questioned. However, the daily triangle did measure for a move to 1.12, and at this point I still have to approach this market with that understanding. Either way, I will base the trade on daily closed candles.

See another pro trader's daily forecast for the AUD/USD here.