By: Colin Jessup

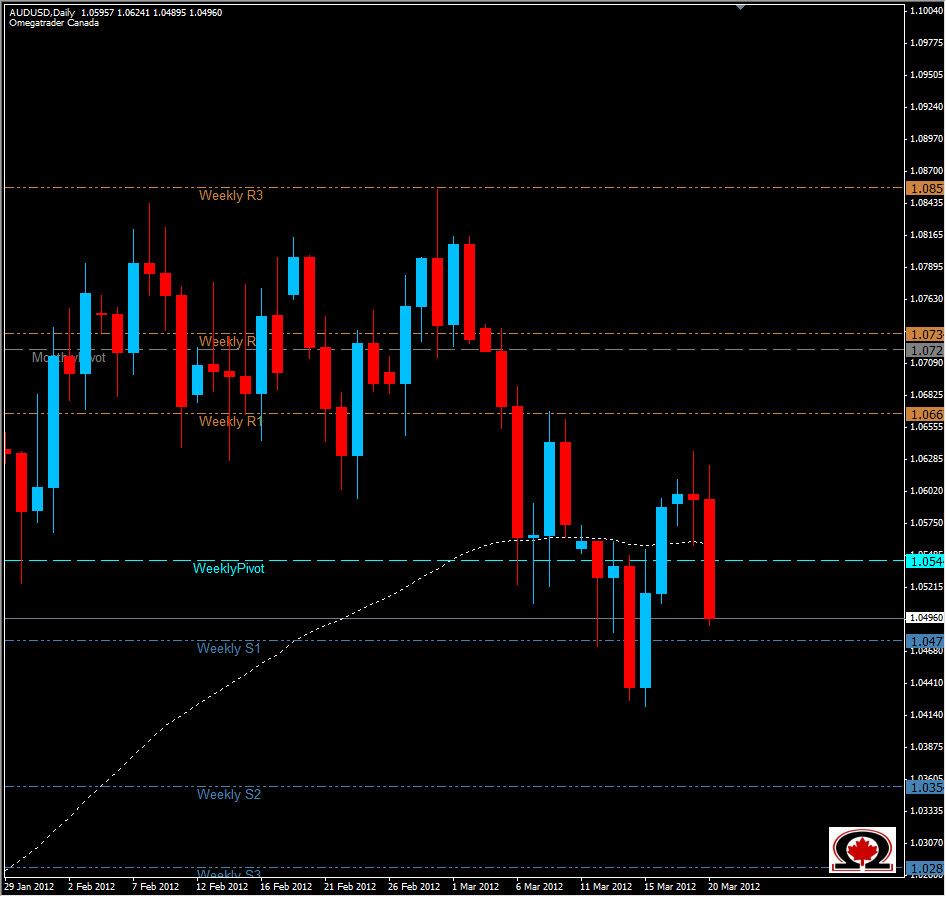

The Australian Dollar is showing strong gains against the USD after the GBP Consumer Price Indexes were released and the Swiss Industrial Production numbers reported 7.5% better than expected. After almost 3 hours of trading in the London Session the pair is rapidly approaching the Weekly S1 at 1.047, a level that price struggled with last week as well. Closing below this level will mean a re-test of last weeks low at 1.0422 and potentially a run for the Weekly S2 at 1.0350. With the Weekly Pivot at 1.054, and Several announcements to follow in the USA session such as Building Permits and NZD Current Account numbers, this could trigger a pullback or even reversal. At this point however the pair is looking very Bearish with strength and volume on its side. If price does turn around there will be the Daily S2, now Resistance to fight through at 1.051, the previously mentioned Weekly Pivot at 1.054 and Daily Pivot at 1.059 to hinder the Bulls progress. Being well below the Daily Moving Average at 1.056 and showing a technical vacuum below 1.043 there is a strong possibility this will continue its bearish descent on the daily charts.