By: Bastian Rubben

Wall Street closed the second trading day of the week in mixed territory, as the technology sector keeps pushing the NASDAQ higher. S&P 500 and Dow Jones closed on the red territory but finished on the day's high. This emphasizes the simultaneous pressure of both sellers and buyers on the US stock markets.

The weakening of the stocks helped the USD to strengthen against some of the major currencies, on the background of improving building permits data, and today the investors will look forwards to the existing home sales data.

The Euro was one of the currencies that was able to resist the USD yesterday and it reached the target I set last week at 1.325. The pair EUR/USD created the "Inverted Head & Shoulders" pattern in the 4-hours chart, under this support and a successful break-up might take the Euro above 1.34. However, if it fails and slides under yesterday's low at 1.3170, the Euro might slide downwards to the support at 1.30.

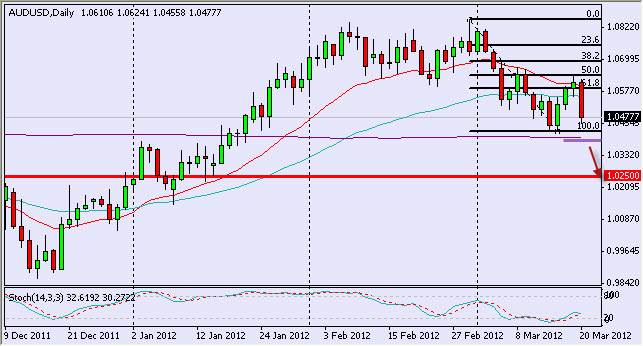

Unlike the Euro, the Australian dollar lost altitude against the USD and made a sharp bearish candlestick in the daily chart. In fact, the pair AUD/USD has been traded in a negative trend for several weeks and it looks like the Aussie finished correcting after it got the support of the 200 SMA around 1.04. The pair made the bearish reversal exactly at the 50% Fibonacci level and it is about to retry breaking down the 200 SMA. If it succeeds, the Aussie might fall to the next support at 1.025.