By: Christopher Lewis

While this pair isn’t one that a lot of traders pay attention to sometimes, it involves two major currencies, and has many dynamics around it that traders should be paying attention to at the moment. In fact, it is in these kind of pairs that we have been seeing some of the best set ups recently. Remember, while there are certain pairs that are indentified with certain other markets, there are normally several. For example, if you are trying to play the currencies markets because of oil, there are other pairs beyond the USD/CAD.

This pair is a measure of several things at one time right now, and yes, oil is one of them. After all, Switzerland certainly doesn’t produce its own oil, and as a result it has to import it. (Whether or not they import from Canada doesn’t matter – they need it, and the oil price keeps going higher, so of course the CAD will be in demand.)

This pair also is a measure of global risk in general. After all, when the investing world is feeling good – they will buy commodities in general, not just oil. This is because they believe that the economy is going to continue to expand, and as a result need more of this “stuff”. In this case, the pair will rise as money leaves the relatively safe confines of Switzerland.

Hammer time

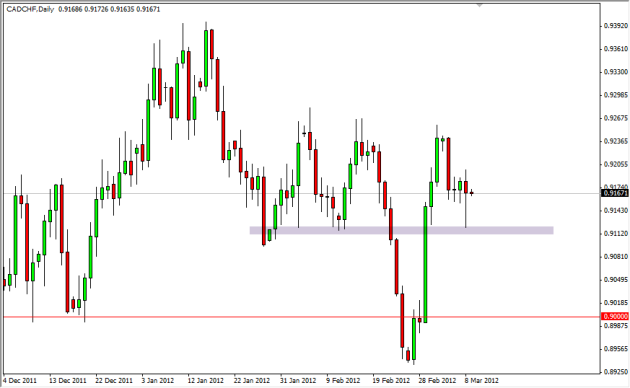

The daily chart shows a nice hammer as the fall on Thursday wasn’t followed through. The move makes sense as the markets saw a lot of the “risk on” trades work. The selling of the Franc and the buying of the Canadian dollar is a great example of this. The 0.91 level is a minor support level, but in my mind is the start of a larger and much more major of a support level that goes down to the 0.90 level.

The market is currently being confined between the 0.91 and 0.9250 levels, and a break higher should see us testing that high again, and any run up in oil should see us push through. With this in mind, I will be watching this pair after the Non-Farm Payroll announcement as if it is good, there should be a flood of money into the commodity dollars, and out of the safety currencies like the Franc.