By: Christopher Lewis

Being Non-Farm Payroll Friday, it is going to always be a difficult trading session. When you add the announcement of participation rates of the Greek debt swap, you have a real shot at getting an almost untradeable amount of volatility. While nobody can actually predict what will happen, the one thing that is certain to be part of the session is massive swings in volatility as the announcement out of Athens will be shortly before the NFP out of the US.

The announcement out of Greece can be massive in scope, but only if it doesn’t work out the way the market seems to think it is going to happen. There is an optimism that the Greeks will get above the 90% participation rate, and this would relieve a ton of pressure on the markets in general. In fact, this would be a real blueprint to some kind of solution. However, this will only be a temporary thing in my eyes, because after the Greeks get 70% of their debt written down, it is only a matter of time before one of the other troubled nations in Europe to ask why they can’t get a deal like this?

Non-Farm Payroll?

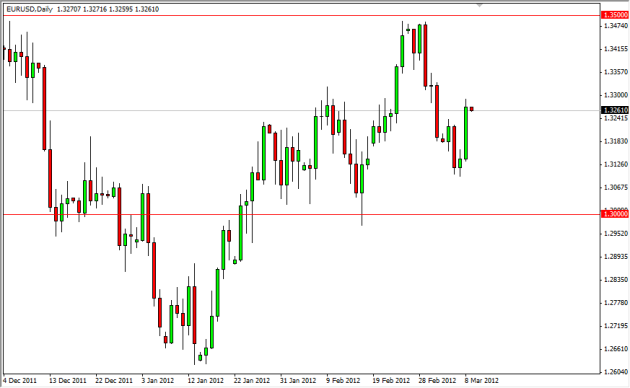

The pair is currently in the middle of the consolidation range between 1.30 and 1.35, and looks as if it is in “No Man’s Land”. This in and of itself makes me a bit leery of getting involved, but one has to think that perhaps the Non-Farm Payroll number could be what the markets are waiting for. Assuming the Greek deal gets done, the labor question will be on everyone’s mind. The jobs number has to be over 200,000 in order to get the market “positive” on the job markets, and as sudden shock could prove to be risk-negative as well. The move will be indicative of what I want to do going forward, but I find it difficult to think that I will be tempted to get involved in the markets on Friday. This is unless we see some really, really bad news out of Athens or DC. In a negative number, we could see a meltdown. Otherwise, I will pass on trading this pair in particular as there is too many headline risks for it.