By: Colin Jessup

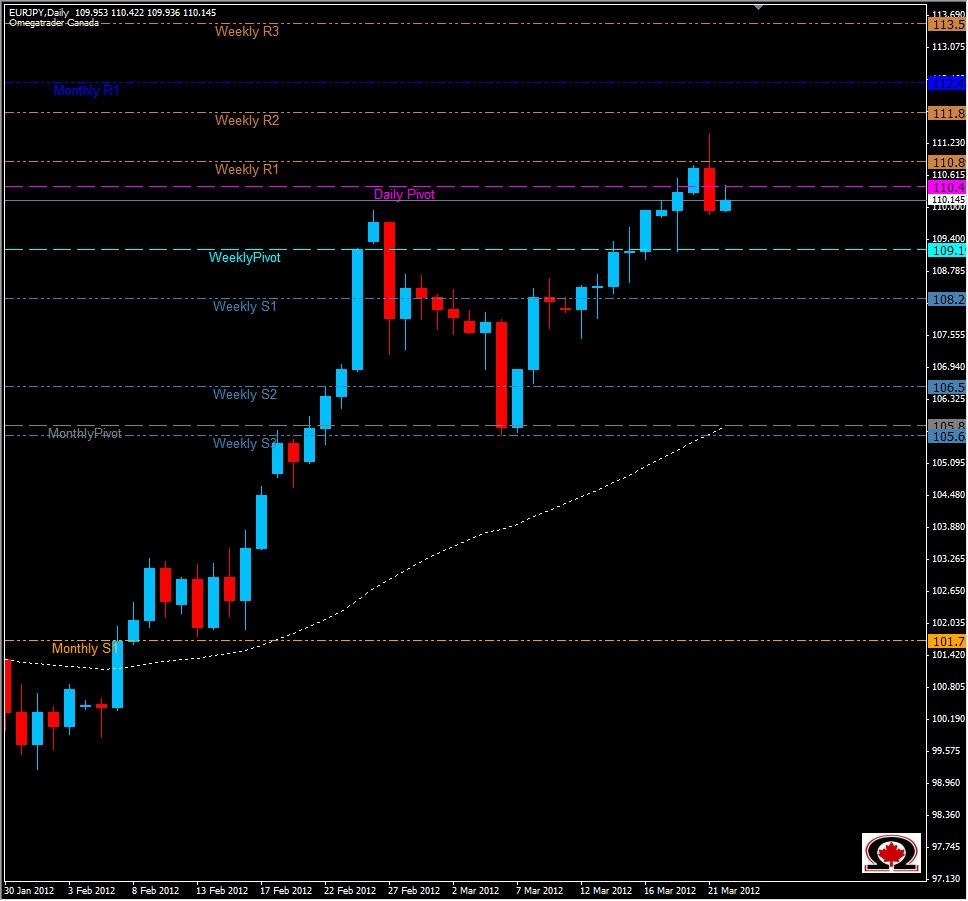

The EUR/JPY pair came within 14 pips of the 6 month high shortly after the London Session opened. The pair then proceeded to reverse and fell 105 pips in the next 4 hours, closing below the Daily Pivot at 110.40 to a daily low of 109.87. During the Asian session the pair pulled back to the Daily Pivot and is presently Bullish with less than 2 hours to the London Open. My observation that price often reverses during the Asian sessions appears to ring true for this pair, on this day. The question is, will the technical vacuum below 109.87 pull the pair lower, or will the Bulls continue to reign when the UK and US sessions resume? With once test of the Daily Pivot level already failing, there is a high probability that the Bears will win and this pair will trade lower later today. There is little in the way of support directly below until the Daily S1 is reached at 109.41 and the Weekly Pivot rests right below that at 109.20. On the upside, we will see minor resistance at 110.26 and above the Daily Pivot we have both the Weekly and Daily R1 very close together at 110.80 and 110.90 respectively. While the pair is in a stronger uptrend, if the trend-line at 110.08 is broken by the Bears this pair will most surely fall at least to the 109.00 level and possibly to the Weekly Pivot which also happens to be the 50% retracement zone for the move higher starting on March 06 of this year.